A Massive VC List 📋

This week we are featuring a podcast that goes deep on SAFEs, a list of VCs applicable for nearly every stage and region, and an analysis on the success of AI companies in health.

Greetings! We hope you’re enjoying some cooler weather. 🍁

⚖️ The SAFE Tipping Point

Peter Walker, Head of Insights at Carta, hosted a podcast with David Willbrand, Chief Legal Officer at Pacaso and author of Seed Deals. They start the discussion on valuation caps and discounts and highlight that they’re seeing discounts fall out of favor as most investors just opt for a valuation cap. The conversation then pivots to liquidation preferences and their repercussions for later stage rounds before finally discussing the integral part a lawyer can play for early-stage founders.

“The compounding effect of SAFEs is what is tripping up founders. I’ve heard that more in 2024 than my entire time at Carta.”

— Peter Walker, Head of Insights, Carta

STV Take: One of the topics this episode explores is the danger of stacking SAFEs. We have discussed this before, but I think the framing of the compounding effect of SAFEs that Peter and David discuss is worth hearing. Again, this is why having great legal counsel is so important. They provide context on market norms and highlight pitfalls they are seeing with similar clients.

The other piece of this conversation that resonated with me is the point made around minute 17. David and Peter note that the focus with a SAFE valuation cap is about ownership not valuation. This is actually a fairly nuanced difference between how some founders and some investors think about round dynamics. As Peter discusses, the question shouldn’t be about a company’s worth but rather how much equity is okay for a founder to part with at a given financing round.

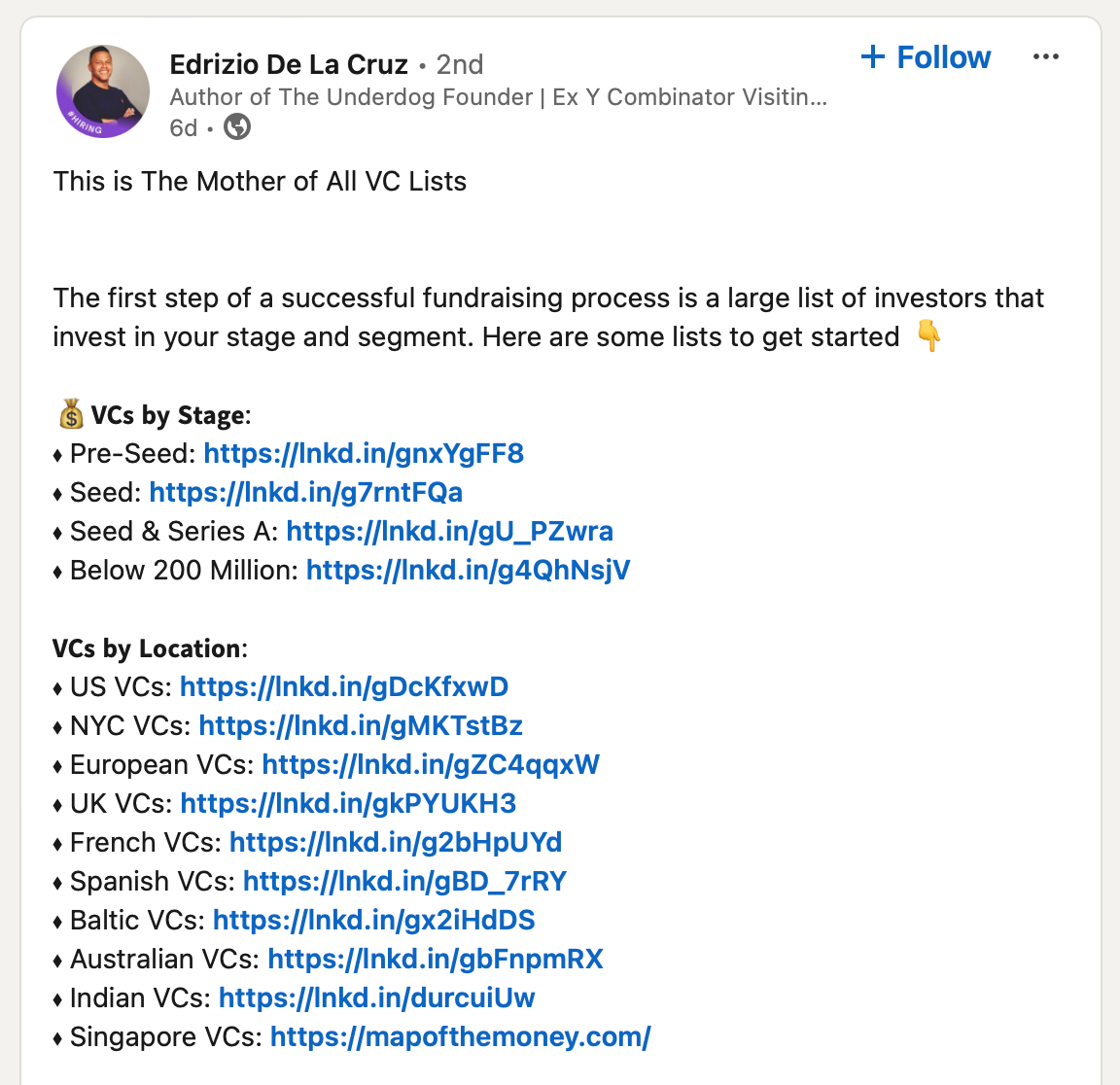

🤩 An Exhaustive VC List

Wow, talk about a list! In a LinkedIn post, Edrizio De La Cruz posted several links to investor lists. It’s broken down by stages, regions, industry, and even angels.

STV Take: We talk a lot about finding the right investor, which I’ll admit can be hard if you’re just starting the fundraising journey. This list can jumpstart your process. The best way to use it is to identify investors that could be a good fit based on their preferred stage, region, industry, etc… Chances are there are at least a few you’ve never heard of. Look folks who work at these firms on LinkedIn and try to find a warm intro. If that isn’t possible, a carefully tailored cold email can work. While it’s less than ideal, as we have discussed before, they are occasionally successful.

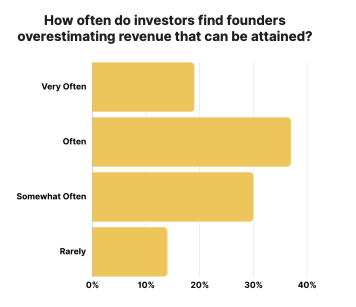

🧭 A Guide to Optimizing Financial Performance

AVL Growth Partners released a new guide that highlights the key three financial drivers of a startup, along with recommendations to help founders avoid common financial modeling pitfalls and the best way to project business growth. A few of the common mistakes AVL Growth discusses in this guide include:

Overestimating attainable revenue

Misunderstanding how quickly revenue can grow related to COGs

Underestimating customer acquisition cost

STV Take: Investors understand that a company’s revenue expectations and growth projections presented in a pro forma are educated guesses at best and shots in the dark at worst. Investors can sniff out the latter. While uncertainty is inevitable regarding early revenue growth, there are techniques and best practices founders can use to generate a solid understanding of their cost drivers and present realistic expectations for potential revenue growth. AVL Growth’s latest guide offers valuable tips to help founders craft the best version of their pro forma. (Sponsored)

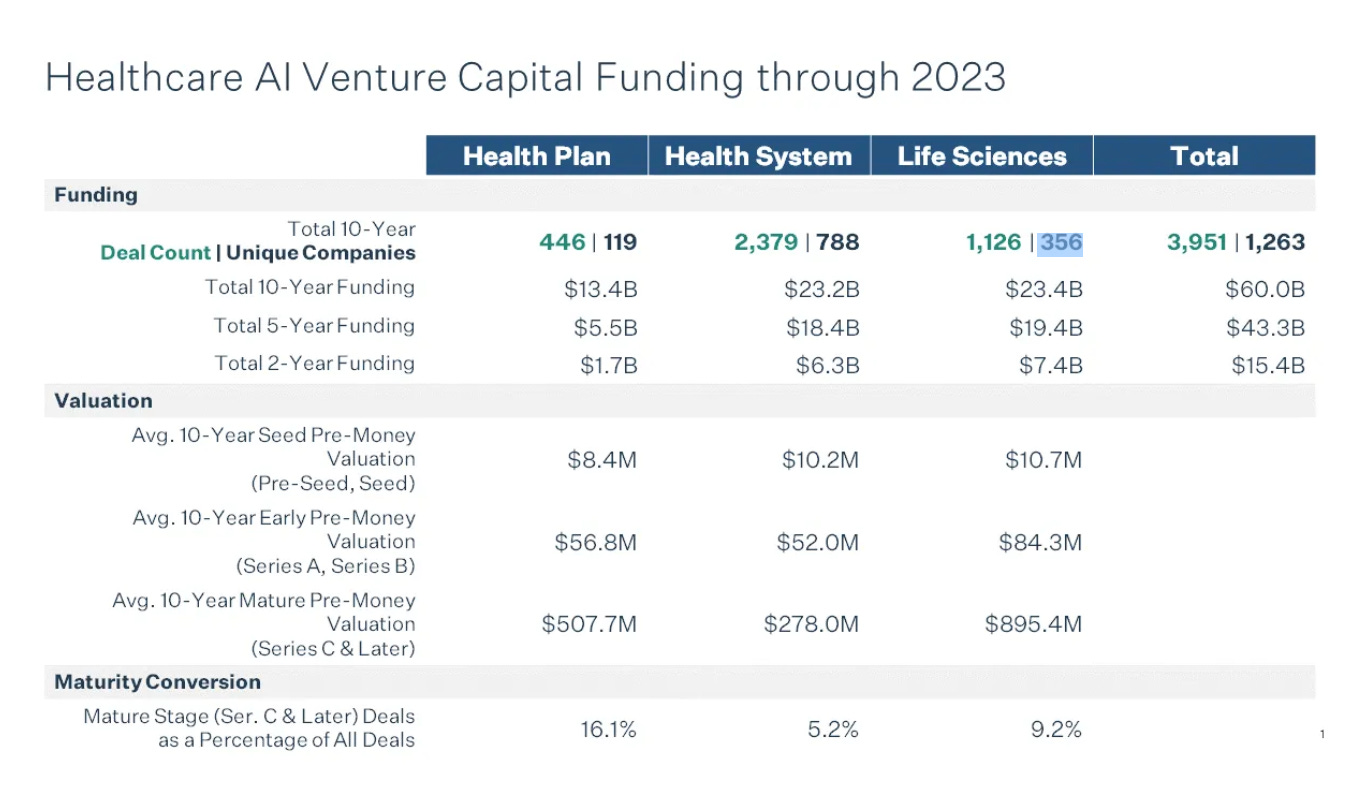

🤔 Unpacking the AI Hype Cycle in Health

Despite the promise of AI, there is still a lot of uncertainty as to how much it will impact various industries. Nowhere is the potential and doubt bigger than in healthcare. Parth Desai, Partner at Flare Capital, recently posted an article that analyzes the past 10 years of healthcare AI funding data to identify the types of companies that are getting traction and which healthcare entities are further along the adoption curve. (Note: If you’re surprised to read they went back a decade, just know that 70% of capital invested into AI healthcare businesses has been in the last five years.) Parth’s analysis shows that AI companies selling to health plans and life science companies have been able to create more value while those selling to health systems lag behind.

STV Take: While there are some assumptions made in this article that equate funds raised with customer traction, I still think this analysis is a valid way to assess which AI companies are seeing adoption. More than that, I thought Parth did a really great job of breaking down why certain customers might be quicker to adopt than others. Regardless of whether you’re building in health, this article can be helpful in refining a target customer base and understanding why investors might have an aversion to companies that sell to certain types of customer entities.