A Podcast, A Book, & A Market Report to Get You Through the Holidays

This week we bring you new funding data on the Pre-seed and Seed stages, along with a (lengthy) podcast and a book.

Happy holidays! We hope you have plans in the next couple of weeks to relax and spend time with loved ones. Given that many folks will likely have some down time (waiting on planes, driving, etc…), we are including a few longer-form content pieces that require a bit of dedication but that we think are worth it.

Quick programming note, this will be our last newsletter of the year, but we’ll return on January 7th.

Thank you so much for spending your time reading and being a part of the VC Minute. We wish you a very merry holiday and happy new year!

🎧 Acquired: Costco

On this episode, Ben Gilbert and David Rosenthal discuss the origin of Costco and all of the twists and turns that bring it to the present day company we all know (and probably love). The episode is loaded with interesting tidbits on the demographics of Costco customers, why Costco’s signature brand is called “Kirkland”, and the different margins across different revenue streams. Like most Acquired episodes, this one is over four hours long but filled with enough nuggets of information to make it fly by.

“Nothing about Costco is an accident.”

—Ben Gilbert

STV Take: There is no shortage of rabbit holes you can go down after listening to this episode, but one of the key takeaways for me is how focused Costco is. Its north star is delivery quality and value to its members and that shows up in every decision that is made about the business. Even the limited inventory, which, if I’m being honest, I used to think of as a negative, is intentional. Sure, it limits choice, but it also enables Costco members to make quicker purchasing decisions (less time deliberating) and have confidence that every product sold is the highest quality.

Investors often harp on the need for companies (and founders) to focus. The Costco story is a great example of why this is so important and what focus really looks like at scale. There are always tradeoffs for every decision, but having a north star helps in understanding the issues that are and aren’t negotiable.

🧭 A Guide to Optimizing Financial Performance

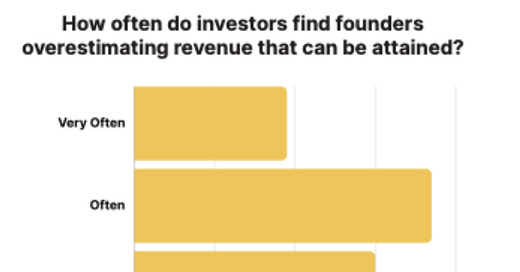

AVL Growth Partners released a new guide that highlights the key three financial drivers of a startup, along with recommendations to help founders avoid common financial modeling pitfalls and the best way to project business growth. A few of the common mistakes AVL Growth discusses in this guide include:

Overestimating attainable revenue

Misunderstanding how quickly revenue can grow related to COGs

Underestimating customer acquisition cost

STV Take: Investors understand that a company’s revenue expectations and growth projections presented in a pro forma are educated guesses at best and shots in the dark at worst. Investors can sniff out the latter. While uncertainty is inevitable regarding early revenue growth, there are techniques and best practices founders can use to generate a solid understanding of their cost drivers and present realistic expectations for potential revenue growth. AVL Growth’s latest guide offers valuable tips to help founders craft the best version of their pro forma. (Sponsored)

📖 State of Pre-seed and Seed Stage Market in 2024

Forum Ventures released their annual report that focuses exclusively on 2024 activity at the Pre-seed and Seed. The report pulls from a survey of 150 VCs and an analysis of over 300 completed investments in the B2B SaaS space. The authors do a great job of slicing the data to help readers get a sense of round dynamics as a result of potentially different factors, including revenue and industry.

STV Take: This report makes it very obvious: the Seed stage is not a monolith. This observation isn’t new, but the report helps reinforce it. The segmentation of round dynamics by areas such as revenue helps founders align on what a realistic round looks like for them based on a number of factors. Keep this in mind next time you read a large funding announcement and are disappointed if you’re fundraising journey isn’t playing out the same way.

🚚 Amazon Unbound

In 2013, Brad Stone wrote a book capturing the origin of Amazon, called The Everything Store. In 2021, he released the sequel, Amazon Unbound, that captures the meteoric rise of Amazon in the 2010s. While the book touches on Jeff Bezos’s evolution over the decade, the primary narrative centers around the various experiments Amazon pursues during this time. Some of the projects are wildly successful, like AWS, but many are not. In addition to the projects, the book also discusses the culture around failure at Amazon and what encourages this type of risk taking.

“We all know that if you swing for the fences, you’re going to strike out a lot, but you’re also going to hit some home runs. The difference between baseball and business, however, is that baseball has a truncated outcome distribution. When you swing, no matter how well you connect with the ball, the most runs you can get is four. In business, every once in a while, when you step up to the plate, you can score 1,000 runs. This long-tailed distribution of returns is why it’s important to be bold”

— Brad Stone

STV Take: The amount of experimentation Amazon did in the 2010s is staggering, especially considering how large Amazon was at the time. It would have been so easy to coast, but Bezos continued to push on new ideas and innovations. He wasn’t afraid of failure, which meant those around him weren’t afraid to take on projects that weren’t a sure bet.

Amazon was truly exceptional in its acceptance of risk. Most corporations, and the people that work within them, have very little tolerance for failure. I think this is a big reason why startups can be so successful—they can take the risk that larger companies can’t. One of a founder’s secret weapons is not just taking those calculated, acceptable business risks but building a culture that rewards employees for doing the same.