A VC Scorecard

This week we are providing insights into how VCs assess companies, market sizing, and new fundraising data from Q4.

Greetings! We are halfway through January… 😬

🌐 Market Sizing in Vertical Software

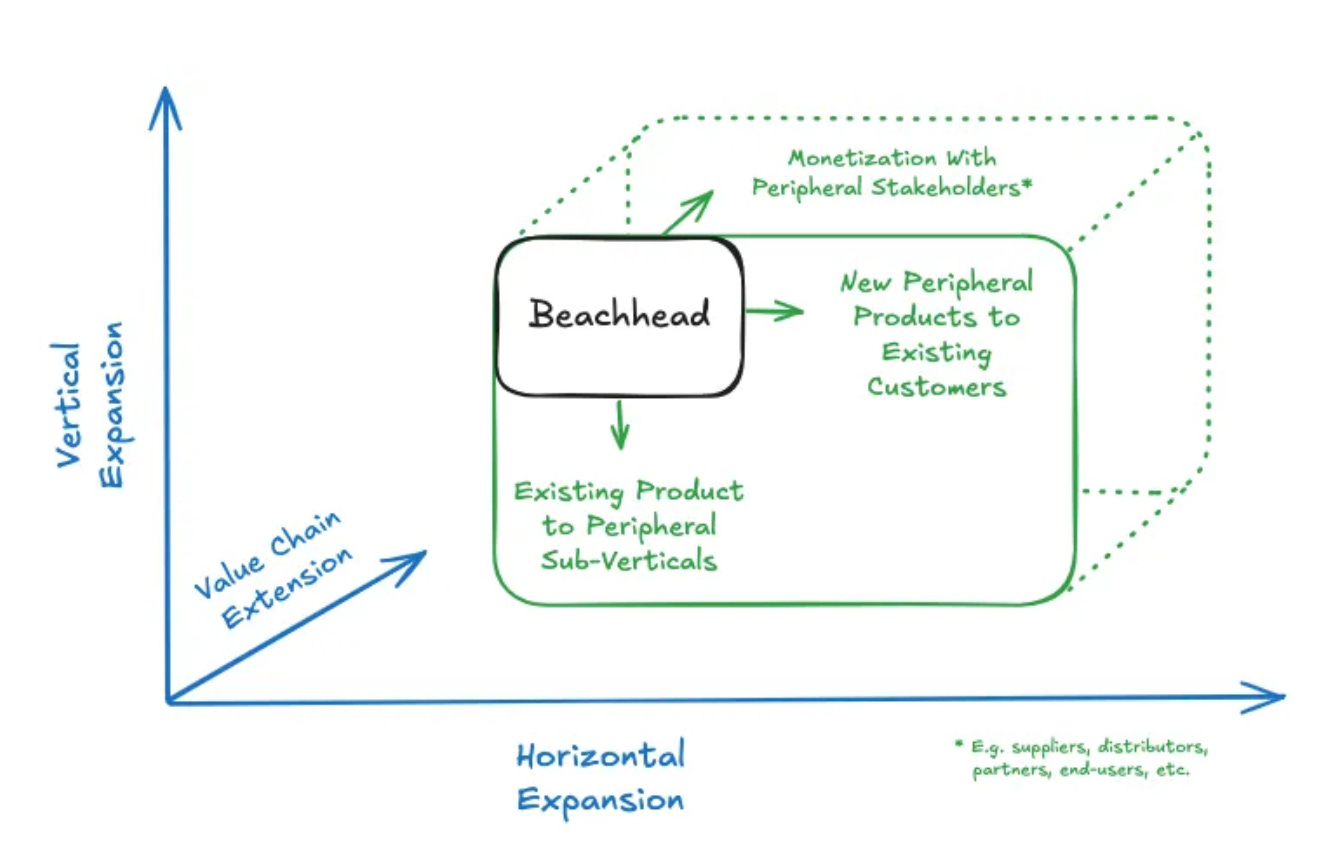

Euclid Ventures released the first article of a two-part series dedicated to helping founders think through the market size of their businesses. The series addresses the well-known VC adage, “huge outcomes come from huge markets,” while offering guidance on what constitutes a market size that’s too small for VC. By examining public companies, the authors demonstrate that an initial total addressable market (TAM) in the mid-single-digit billions can still support successful venture outcomes. The article also cautions that calculating TAM early on can be misleading. Instead, the authors emphasize the importance of focusing on TAM expansion over time.

STV Take: There are some great pointers in this article for founders at any stage of defining their market. For those new to market sizing, Euclid’s emphasis on a bottoms-up approach to defining TAM is particularly noteworthy. For instance, if you’re building in healthcare, stating that your market size is the $4.9 trillion dollars spent on healthcare in the U.S. tells investors little. In fact, it signals a lack of understanding about where your business fits within such a vast market. Specificity is crucial in conveying a credible market opportunity.

As the article reiterates, understanding the initial TAM is only part of the equation. Venture history is filled with examples of missed opportunities where initial TAM analysis caused investors to overlook what later became massive businesses, such as Uber. This underscores the importance of TAM expansion, particularly for companies targeting a small beachhead market. The framework provided in the article offers a practical way to explain TAM growth over time. Ultimately, to be successful in fundraising, founders need to demonstrate how their starting market can realistically lead to broader TAM expansion and unlock a bigger opportunity over time.

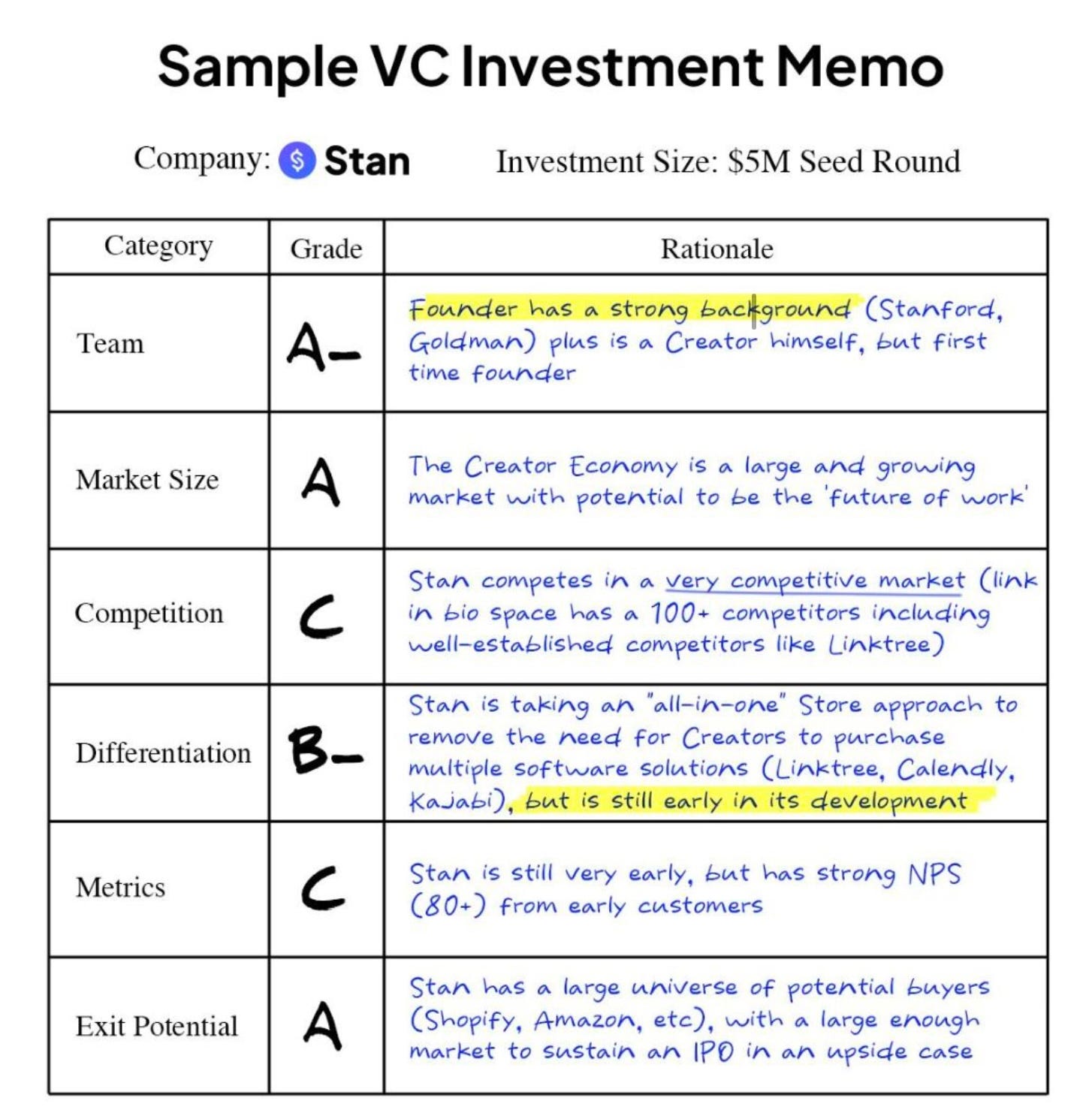

🗒 A VC Score Card for Early-stage Companies

In a LinkedIn post, Ivelina Dineva shared a scorecard from another founder, John Hu, who also happened to work at a VC firm prior to raising money for his own startup. Below is the scorecard John’s prior firm used. Some of the questions John and his prior venture team would answer within each section include the following:

Is this the best team to solve this problem?

How crowded is the space?

What sets this startup apart from competitors?

STV Take: While the output may look slightly different, this scorecard is a good distillation of what every VC assesses when looking at an investment opportunity; we have a similar version of this that we use at SpringTime. As you’ll see in the above image that John uses to analyze his own business for investment, not every category needs to be an A+. In fact, at the earliest stages, investors expect a few of these categories to be works in progress.

For founders, it can be helpful to think through how their team and business stack up in each of these categories before going out to fundraise. This provides an opportunity to spot potential weak areas investors might identify and think critically about how they can be addressed.

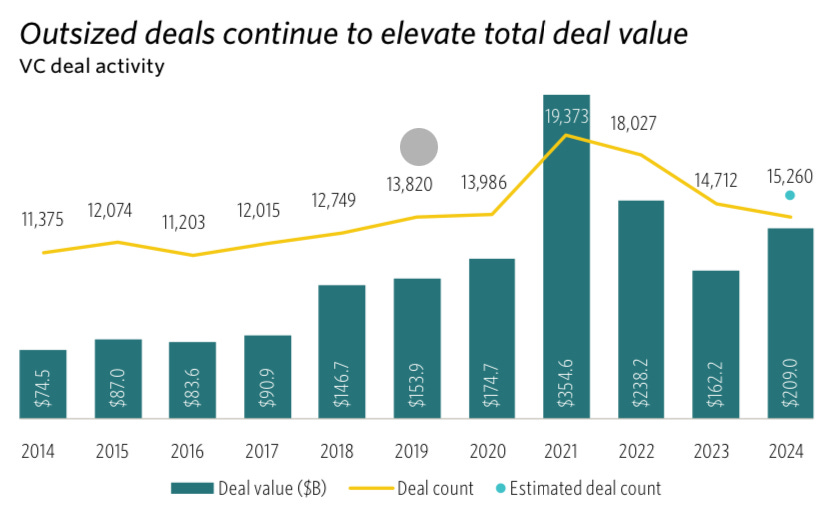

📕 Venture Monitor Report

Pitchbook and NVCA released their report on Q4 2024 venture activity. The key takeaways are generally somber with a bit of optimism mixed in. The executive summary of the report gets right to the heart of it: the ecosystem needs liquidity. The number of exits with values greater than $500M was only 3.6% in 2024, meaning there is still a significant amount of illiquidity in the venture market. Dealmaking activity, though, provides some optimism. While deal count didn’t match the peaks of 2021 and 2022, it did increase from 2023 and was higher than pre-pandemic years.

STV Take: As readers of this newsletter likely know, venture hinges on large outlier exits. While smaller exits are encouraging, they don’t move the needle for fund managers, or more importantly, their LPs (the folks who invest in venture capital funds). Until we start seeing investors able to realize liquidity out of their biggest winners, the market is likely to remain subdued.

Another notable trend discussed in the article is the growing bifurcation in both investment deals and new fund formation. Whether you're a Seed-stage company or a fund manager, it often feels like a hot or not scenario. For instance, 60% of the capital raised for new funds came from just 20 firms. Hopefully, this dynamic shifts as fund managers—particularly those managing their first few funds—achieve meaningful liquidity events and build stronger track records.