AI Market Saturation

This week we are bringing you insights into potential AI market saturation and a list of active angel groups in the Southeast.

Greetings! Lots going on this week, so this wound up being a day late!

🏅AI Market Leaders

TechCrunch published a summary of a TechCrunch Disrupt interview with Elad Gil, a prolific angel investor who has been investing in generative AI companies since 2021. The gist of the synopsis centers around how much uncertainty there is around AI but also how there are markets where winners are starting to emerge. These areas are usually marked by well-funded companies with a clear leading edge with users, like foundational models (OpenAI), AI-assisted coding (Cursor), customer support (Decagon), legal (Harvey), and medical transcription (Abridge). In addition to identifying categories where the white space might be more limited, he discusses the false signal AI companies are generating because so many enterprise customers feel like they will be left behind if they don’t experiment with AI. While companies are spending on AI, it’s unclear whether that revenue sticks.

“The CEOs of every big company are basically telling their teams, hey, we have an edict. We need to figure out our AI strategy… These giant enterprises are willing to try things that two years ago they never would have tried, and it’s only because of AI.” — Elad Gil

STV Take: Elad Gil’s categorization of AI markets into “decided” versus “wide open” matters because VCs are increasingly hesitant to fund companies competing against perceived category leaders, even exceptional execution gets dismissed as “too late” when investors believe winners have emerged. For founders, this means either dominating a greenfield category or having an ironclad wedge strategy if you’re entering contested territory, because “we’ll execute better” is no longer a fundable thesis against established players with momentum and mindshare.

👎 Is VC Worse than 2021?

In a recent VC20 podcast episode, host Harry Stebbings discusses with Jason Lemkin and Rory O’Driscoll the state of VC in the wake of the AI hype. They analyze Revolut’s $3 billion fundraise at a $75 billion valuation, debating TAM (total addressable market) exhaustion concerns and whether the rapid adoption of AI tools represents sustainable growth or a temporary “everyone’s in market” phenomenon similar to COVID-era buying patterns. The discussion then segues into a debate on whether current AI vertical market investments are overvalued given the compressed timeline for customer adoption and uncertain long-term market sizes. The conversation concludes with reflections on venture capital cycles, the challenge of temporal diversification when fund cycles have compressed to 18 months, and differing views on whether this is the easiest or hardest time to be a venture investor.

“Everyone’s at market in the first time forever. Every law firm... Now, because of AI, everyone’s being yelled at and said, go find a tool and they’re buying... The fact that everyone’s in market instead of 5% of the market, which is like our traditional metric in B2B, is warping how we think about market size. It’s like 2020 all over again, when everyone was in market for a contact center or e-signature... Everyone was in market and then they disappear the next year.” — Jason Lemkin

STV Take: The podcast’s TAM exhaustion debate directly validates Gil’s warning about entering “decided” categories. What looks like massive market expansion is often just compressed buying cycles where every company purchases AI tools simultaneously, then stops buying. Lemkin’s point that legal AI went from unfundable to overfunded illustrates why VCs backing late entrants face impossible math: they’re paying 2025 euphoria valuations for markets that could very likely revert to normal adoption within a year or two. For founders, this means you either dominate during the current “everyone’s buying” moment or risk building solid products that miss their market timing entirely.

👼 Active Angels

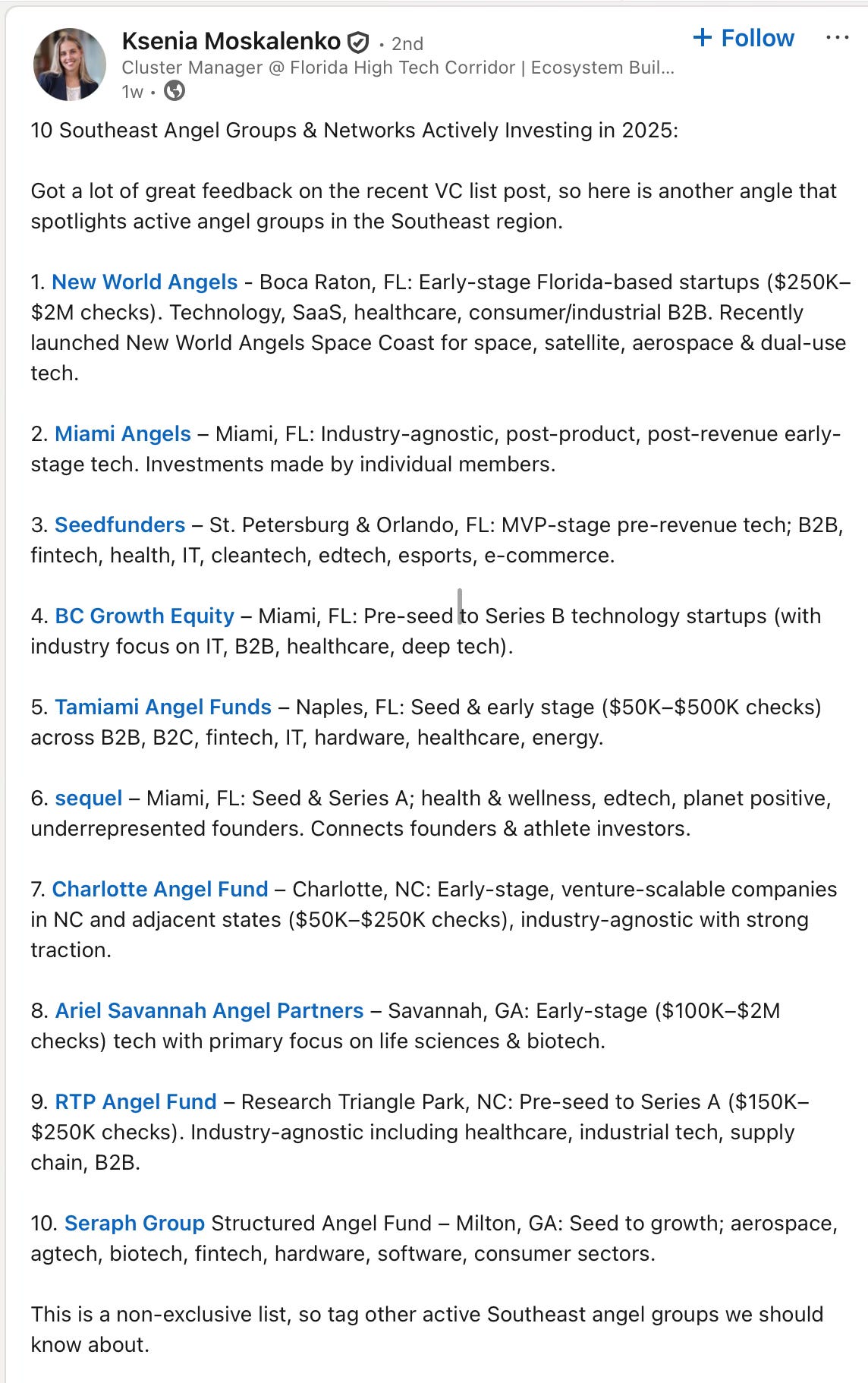

Ksenia Moskalenko has been posting lists on her LinkedIn of active early-stage investors. Her most recent one included ten angel groups actively investing in the SE and a breakdown of what each is interested in.

STV Take: We frequently get asked for recommendations for angels and angel groups, and while we have a few faves, they are usually very specific to our core investment areas, which is why we will often refer founders to find lists, like Ksenia’s, to broaden their search. Just remember, like every VC firm, every angel group has their own unique preferences and processes. Make sure you take the time to talk to other founders who have gone through an angel’s process and can help you decipher if it’s right for you.