Alternatives to the Large Pre-seed Round

This week we are bringing you more data on the state of venture funding, an alternative path to a large Pre-seed round, and lessons from Service Titan’s investment memo.

Greetings! Welcome to February and another six weeks of winter 🥶

📊 The State of Startups in Charts (Crunchbase Edition)

Crunchbase released their twelve biggest takeaways after analyzing 2024 funding data on their platform. Key data points include the following:

$100B was invested in AI companies in 2024, with a small number of companies capturing billions of that figure.

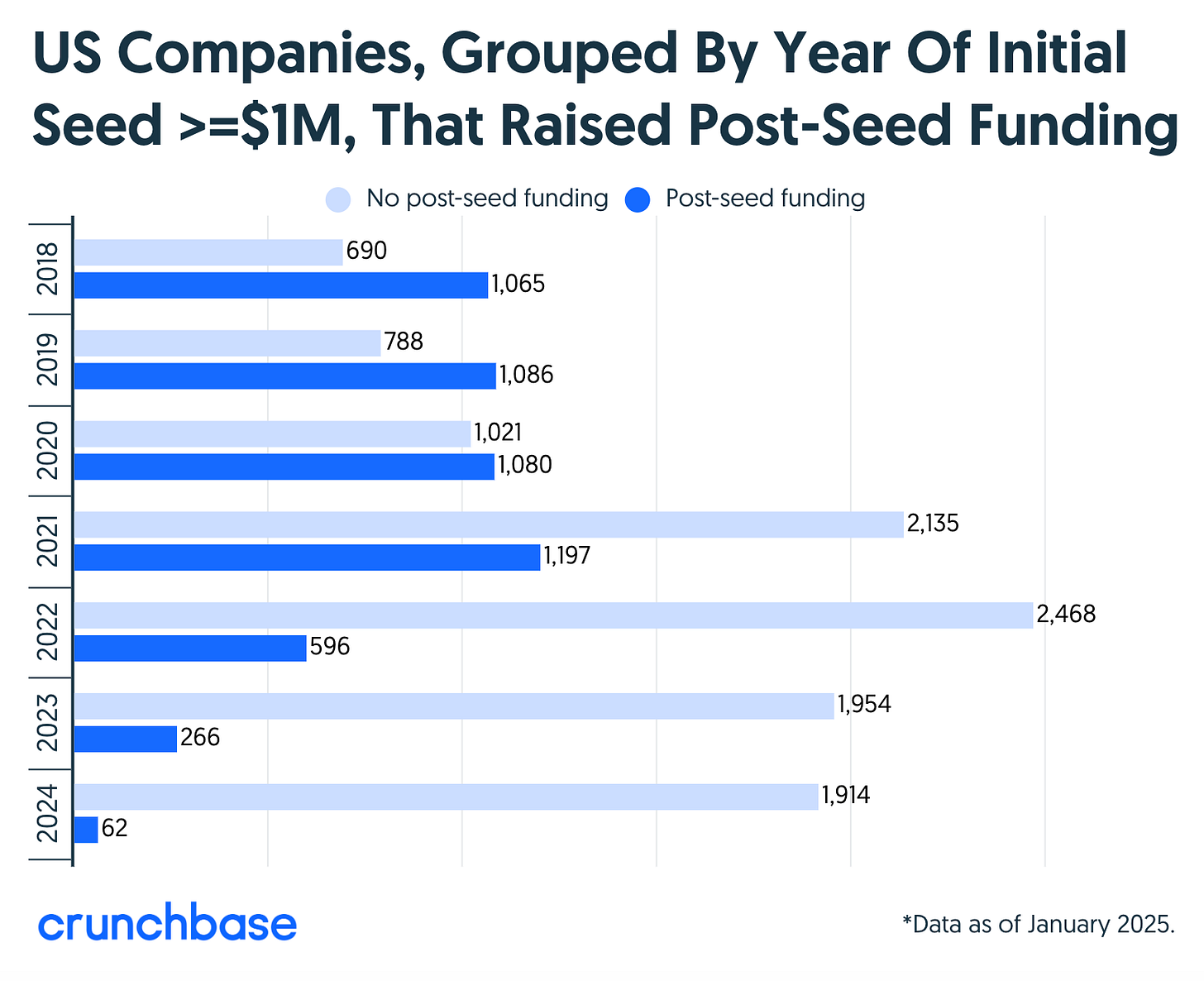

Only 24% of the companies that raised a Seed round greater than $1M in 2022 have secured post-Seed funding as of Jan 2025.

M&A deals involving venture-backed companies were up 7% in 2024 relative to 2023.

STV Take: The number of Seed-stage companies that haven't raised Post-Seed funding since 2021 is shocking. Many of the companies that were able to raise Seed rounds in 2022 were caught off guard by the increased metrics needed to secure Series A funding. As a result, many of them have raised bridge rounds over the last few years to extend their runway. However, based on my conversations with other investors, time is running out. Some companies have reached the necessary milestones and will be able to raise a Series A, but many others will have to make difficult decisions about their future. It will be interesting to see how this unfolds over the next year.

🤔 Rethinking Valuations at Pre-seed

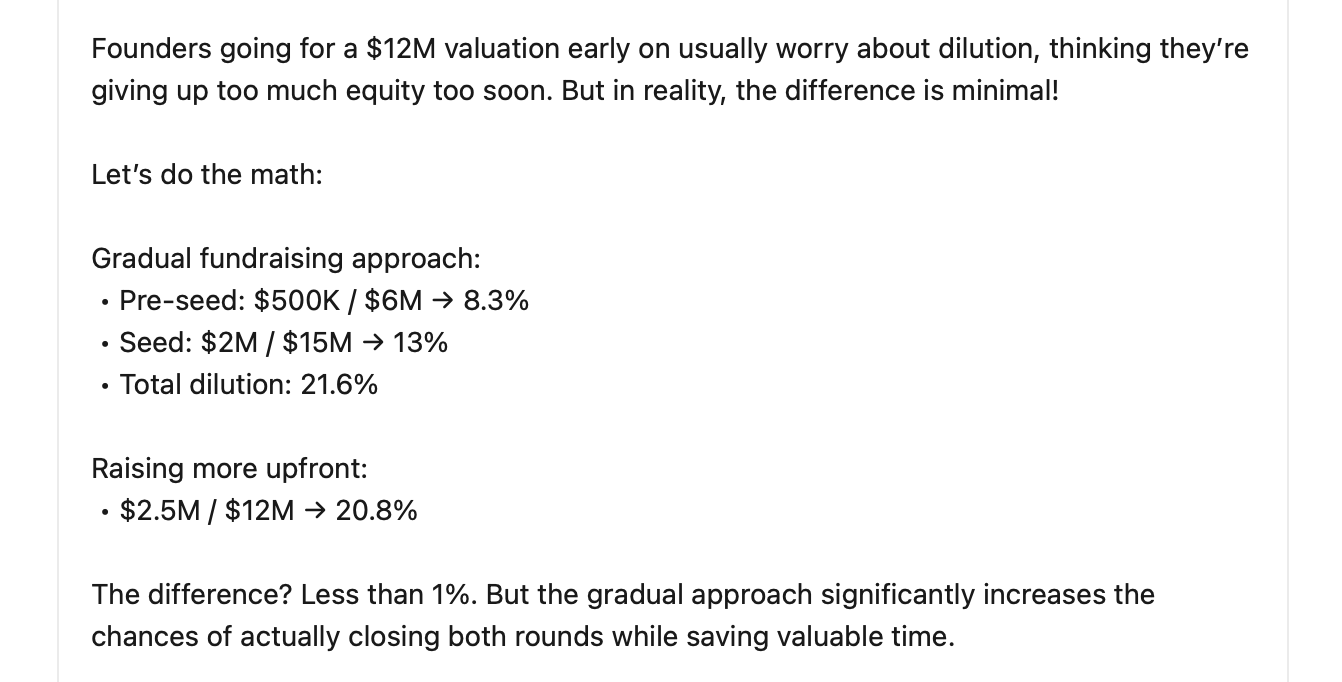

On LinkedIn, Alex Zhuravlev, General Partner at Mento Ventures, discusses a common trend he is seeing at the Pre-seed right now: Founders trying to raise >$2M on a $12M post-money. Unfortunately, in his experience, these rounds just aren’t getting done, primarily because raising at a $12M valuation before there is a product or traction creates downstream fundraising issues. He suggests a better strategy is to raise $500K to $1M at around a $6M post, which can set the business up to raise a proper Seed round at a higher valuation in six to 12 months.

STV Take: Raising substantial capital during Pre-seed or Seed rounds can lead to considerable challenges in securing the next round of funding. While a large initial investment may seem advantageous, it sets a high bar for future performance. Subsequent investors will expect to see significant growth and strong fundamentals to justify the company's valuation. This creates immense pressure for startups to achieve rapid growth between funding rounds. It’s hard enough to build an enduring business and secure funding; founders only make it harder on themselves by raising the bar too high early on.

📄 Service Titan Memo

Bessemer Venture Partners released their investment memo for their lead check into ServiceTitan’s $18M Series A. In it, they discuss the risks associated with the business—including the ability to sell to smaller businesses, a revenue backlog, and no prior large software companies going after this segment. Despite these, what ultimately got Bessemer excited? The business’s strong momentum and growth with zero sales and marketing spend.

“We are excited to back a hungry team with a strong product that is making waves in an industry that has been largely left behind by modern software.” — Bessemer Venture Partners team

STV Take: Fundraising for a vertical SaaS tool, especially one in a market with so many small businesses is challenging. This memo is an interesting look at how investors evaluate and think about similar companies. Granted, ServiceTitan’s Series A was done in 2015 (what a different time!), it is astounding how quickly ServiceTitan was growing with no sales and marketing spend; the growth was driven primarily by referrals.

For founders, one of the key takeaways is how critical showing early momentum is. Admittedly, this is harder to do at Seed than Series A, but showing that the product is a need versus a want for a buyer is critical. For ServiceTitan, the growth through referrals helped validate the pain ServiceTitan’s customers were feeling and how well Service Titan solved the problem.