An Intro Guide to Raising a Seed Round

This week we feature advice for raising a Seed round, data on how VCs make decisions, and when to just send the deck.

Greetings! We are gearing up for our annual LP meeting this week and are excited for in-person time with the team and SpringTime supporters!

👩🏫 Raising a Seed Round 101

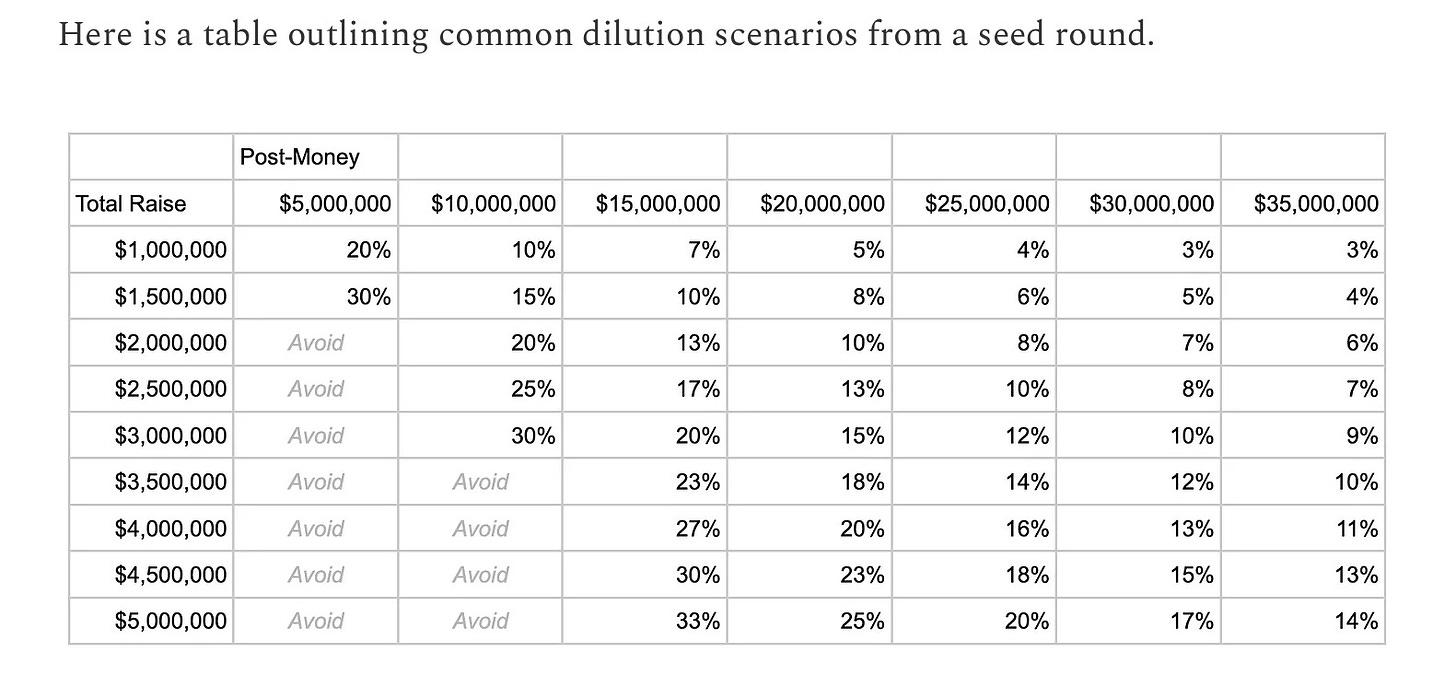

A recent entry in Lenny’s Newsletter features a comprehensive guide to raising a Seed round based on Terrrence Rohan and Jack Altman’s observations across 1K Seed fundraises and additional input from founders who have successfully raised millions for their companies. This guide opens with the question of whether venture capital is the right path for a founder and their business and the three convictions founders should have before pursuing this type of financing. It then discusses various components of the pre-fundraise, such as what investors will expect founders to have demonstrated before investing, how much founders should think about raising at the first Seed round, and how to optimize for a great round. There are also useful pointers on how to approach different aspects once the fundraise gets underway, including selecting the right investors and negotiating terms.

STV Take: The authors do a great job of weaving in both quantitative and qualitative data into their advice. I especially like the table above that shows some rough back-of-the-napkin math on dilution and what is best to avoid. In this same section, the authors discuss raising an amount that gives the company 24 to 36-months of runway with a 25% buffer. This is such an important point: Founders need to give themselves enough runway to get to Series A milestones. It always takes longer than expected and founders don’t want to be in the unfortunate position of having to go back out to fundraise without proof points. In other words, the fundraising strategy shouldn’t be to raise a small Seed round and then raise a Series A in six months (or even 12 months), as Episode 40 of the VC Minute discusses.

🧭 A Guide to Optimizing Financial Performance

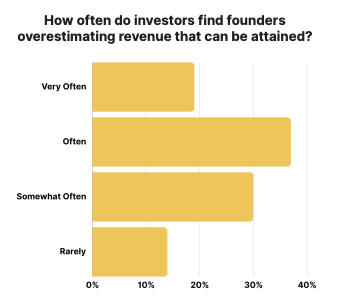

AVL Growth Partners released a new guide that highlights the key three financial drivers of a startup, along with recommendations to help founders avoid common financial modeling pitfalls and the best way to project business growth. A few of the common mistakes AVL Growth discusses in this guide include:

Overestimating attainable revenue

Misunderstanding how quickly revenue can grow related to COGs

Underestimating customer acquisition cost

STV Take: Investors understand that a company’s revenue expectations and growth projections presented in a pro forma are educated guesses at best and shots in the dark at worst. Investors can sniff out the latter. While uncertainty is inevitable regarding early revenue growth, there are techniques and best practices founders can use to generate a solid understanding of their cost drivers and present realistic expectations for potential revenue growth. AVL Growth’s latest guide offers valuable tips to help founders craft the best version of their pro forma. (Sponsored)

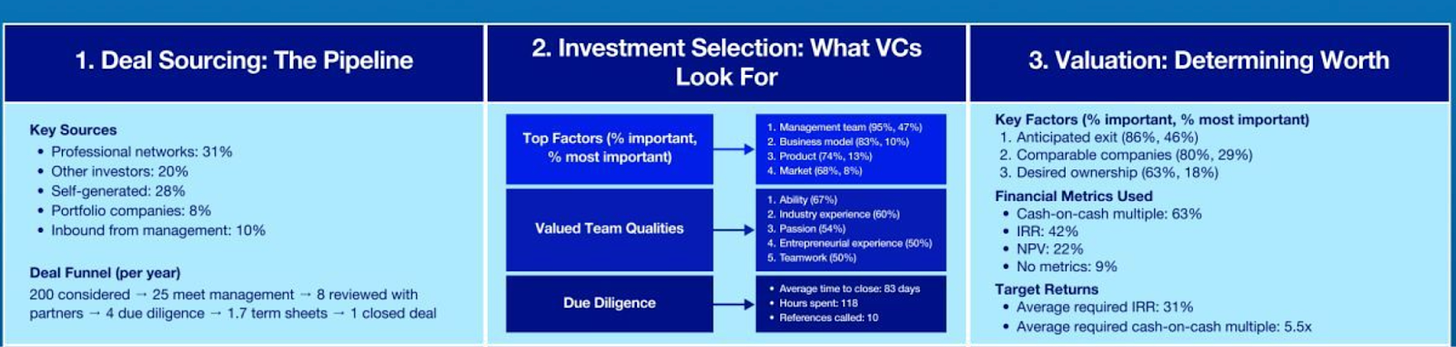

💭 How VCs Make Decisions

Chris Tottman, Partner at Notion Capital, posted a graphic (a portion of it is shared below) to LinkedIn that summarizes a working paper from the National Bureau of Economic Research. This working paper surveyed 885 institutional investors across 681 firms on key components of a VC’s job, including deal sourcing, investment selection, and LP relationships.

STV Take: I’ll start by saying that the working paper Chris pulls this from includes data that is over a decade old; however, I think this breakdown is still helpful for founders to see (and obviously, so does Chris). It’s also just interesting to think about what has and hasn’t changed. For example, team was the most important piece of criteria for 47% of respondents. My immediate reaction is that this has either stayed the same or potentially increased as software has become easier to build and defensibility really comes down to a team’s unique insights and network. Articulating why you’re the founding team to build a massive business around a particular problem is more important than ever.

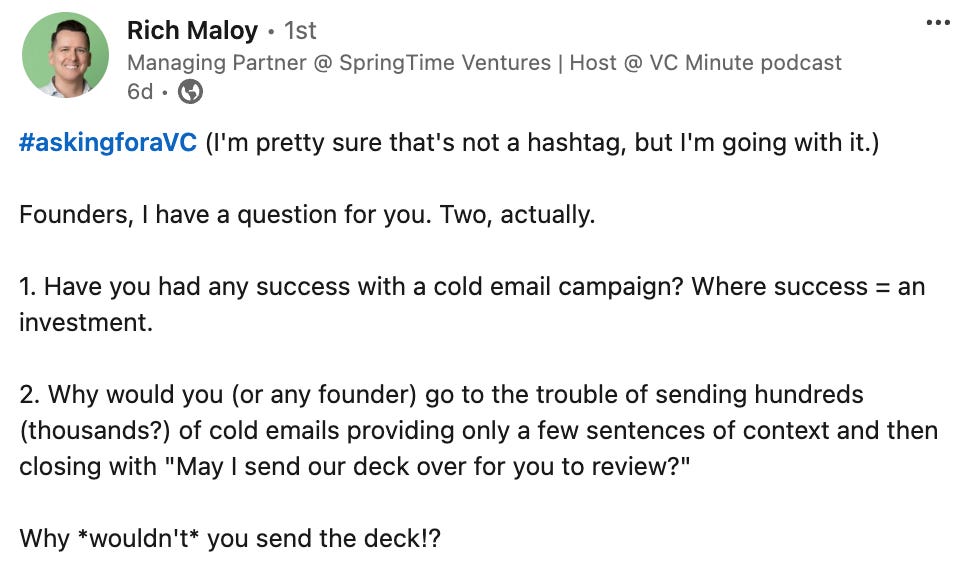

⁉️ Asking for a VC

SpringTime’s Rich Maloy is back this week with another question for the LinkedIn community. In a recent post, Rich asks two questions related to cold email campaigns. The first is whether founders have successfully received investment from a cold email and the second is why founders would go through the effort but not send the deck. Rich lays out his thinking on why he thinks not including the deck in the email is a bad strategy. Most notably, he believes effectively using Docsend opens up a whole new world of potential follow-ups.

STV (okay, Allyson’s) Take: Lately, I’ve been inundated by these emails asking whether someone can send me a deck. I’ll be honest, most of these are far outside of SpringTime’s scope, so even if they sent the deck, I wouldn’t have opened it. That said, I think the comments in this thread provide some interesting insights into why founders may or may not decide to include the deck in a cold email to an investor. One resounding answer to Rich’s question was that this tactic was to avoid spam filters. Another was that these emails actually come from folks being hired to help founders fundraise; thus, in order to earn their fee, these investment brokers just send a bunch of emails to a broad list of investors. Founders, please remember that you should be the one fundraising. Seed investors will almost always automatically pass if an investment broker is present.