Crafting a Forwardable Email

The week we discuss the forwardable email, recurring vs reoccuring revenue, and benchmarks on advisor equity.

Greetings! We are enjoying a busy week at Venture Atlanta. We hope you’re having a great one!

🎨 The Art of the Forwardable Email

Connie Dadon, an investor at Emerson Collective, posted an article on the framework she uses to craft a forwardable email. Before making an intro, most connectors will ask if the person identified for the potential intro is open to meeting the person making the request, a.k.a., the double opt-in. A forwardable email is a customized email that an individual facilitating the intro can use to do the double opt-in.

“A GREAT forwardable email is succinct and to the point. It shouldn’t be a huge time investment for the receiver to read your entire email and it shouldn’t be difficult to figure out why you want to connect with them.”

STV Take: Investors facilitate a lot of intros between all sorts of folks. Connecting people is a fun, rewarding part of the job, but because of the volume of intros investors do, it can become overwhelming. When folks do the double opt-in email, they want to make sure they are putting the best foot forward of whoever is seeking the intro, but they often don’t have all of the details or proper messaging to make it as compelling as the person who wants the intro. The forwardable email is so powerful because, if done well, it enables the person seeking the intro to control the messaging, getting the best information in front of the person at the moment they’ll decide whether it makes sense to connect. And, of course, it makes the life of the connector much easier.

🧭 A Guide to Optimizing Financial Performance

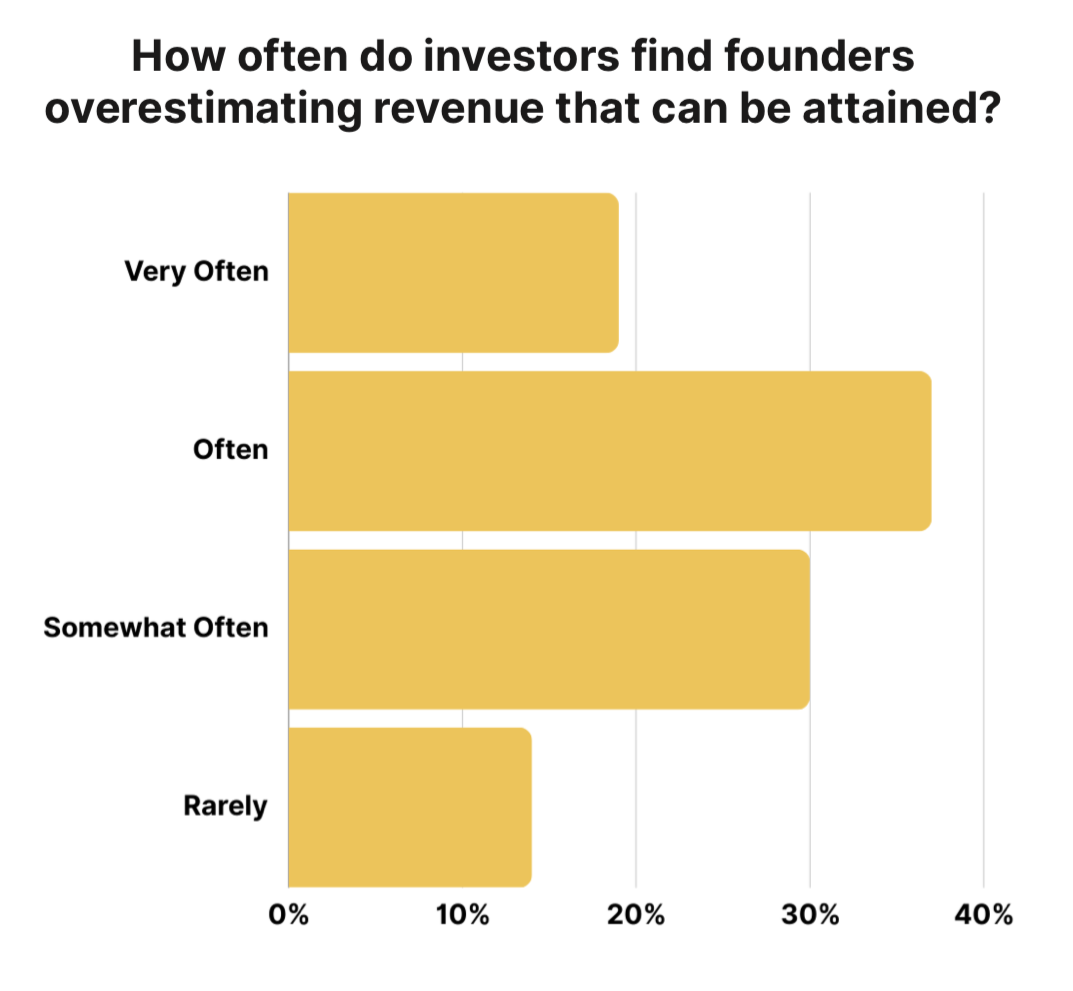

AVL Growth Partners released a new guide that highlights the key three financial drivers of a startup, along with recommendations to help founders avoid common financial modeling pitfalls and the best way to project business growth. A few of the common mistakes AVL Growth discusses in this guide include:

Overestimating attainable revenue

Misunderstanding how quickly revenue can grow related to COGs

Underestimating customer acquisition cost

STV Take: Investors understand that a company’s revenue expectations and growth projections presented in a pro forma are educated guesses at best and shots in the dark at worst. Investors can sniff out the latter. While uncertainty is inevitable regarding early revenue growth, there are techniques and best practices founders can use to generate a solid understanding of their cost drivers and present realistic expectations for potential revenue growth. AVL Growth’s latest guide offers valuable tips to help founders craft the best version of their pro forma. (Sponsored)

🥊 Recurring vs. Reoccuring Revenue

C.J. Gustafon, a tech CFO, penned a Substack on the differences between recurring and reoccuring revenue. In short, recurring revenue is revenue that is generated consistently at a predictable amount and in ideal scenarios is bound to that payment schedule via a contract. Reoccuring revenue is generated through repeat customers but the timing and/or amount is not regular. The key difference between the two is that recurring revenue is predictable while reoccurring revenue is not.

“At the risk of being too basic, a typical SaaS business charges you the same amount each month - regardless of the number of days in a month or your product usage. This de-risks performance, and therefore valuation, to a degree.”

STV Take: It raises a red flag when a founder claims a specific amount of recurring revenue, only for investors to discover that it’s actually reoccurring revenue. This situation reflects poorly on the founder, whether it’s intentional deception or a lack of understanding. Either way, it’s likely to make investors hesitant. Not every model is pure SaaS, and that's fine—just be clear about what constitutes true recurring revenue.

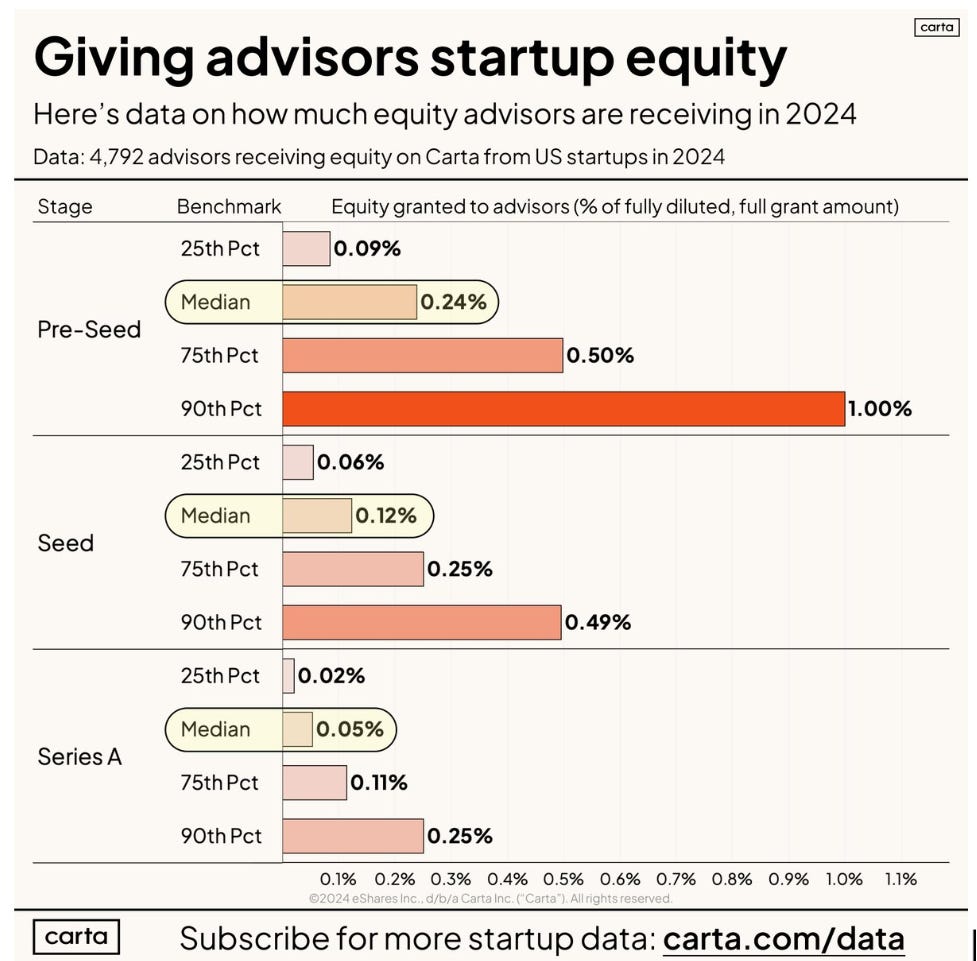

🧐 Advisor Equity

Peter Walker, Head of Insights at Carta, published stats on X on the median amount of equity granted to advisors at the Pre-seed, Seed, and Series A. The chart below shows the range across the different stages:

STV Take: While granting advisors equity can be a great way to incentivize industry experts to get involved with the business, equity is expensive. Knowing what is standard for advisor equity grants is the first step in creating a successful advisor relationship. The next step is to make sure expectations are clear on what the founder expects of the advisor and vice versa. We have seen both advisors and founders get frustrated with their arrangement, and more often than not, it comes back to misaligned expectations because none were set from the start of the engagement.