Demystifying Angel Investors

This week we cover finding and selecting angel investors, Q3 Pre-seed data, and how to escape the ultimate startup catch-22.

Greetings! Hard to believe we are almost a week into November. 🍁

👼 Picking the Right Angel Investors

On a NY Seed Round podcast episode, host Justin Wolz interviews Ben Zies, General Partner of SuperAngel Fund, to discuss common startup mistakes and how to find and pick the right angel investors. Since Ben is a former founder of a proptech company that didn’t work out, the first part of the conversation centers around reflections on what Ben learned from that failure (& he’s very open about calling it that). Then, Ben discusses angel investing, what he looks for in founders, and his current role at SuperAngel.

“Failure in a company does not mean you’re a failure as a person.”

—Ben Zies

STV Take: The first thing to note about this episode is that the conversation around failure feels refreshingly real. Beyond that, this podcast provides helpful insight into engaging angels. Ben notes how hard it can be to raise angel funding if you aren’t an experienced founder, so a critical part of getting an angel interested is bringing them along for the journey. Tactically, this means sending investor updates.

Updates help angels see a founder’s performance in a trend line versus just a single moment in time. Despite how common this knowledge is, I’m always surprised by how few founders actually do this. I get the earliest stages are full of fits and starts. Sometimes it just doesn’t feel like there is much movement, but getting into the habit of doing updates at least quarterly enables founders to build credibility with angels while also instilling a healthy amount of reflection on the business.

📊 State of Pre-seed

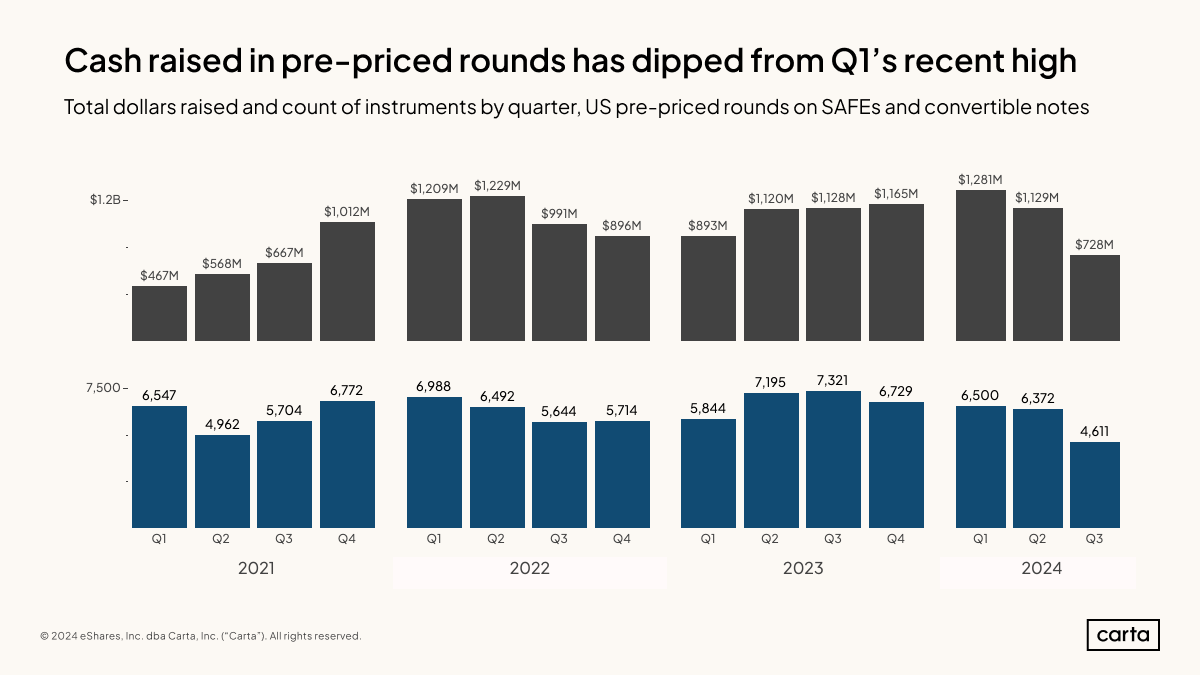

Carta released the State of Pre-seed: Q3 2024 report, which provides data on the latest trends in Pre-seed funding. A few interesting stats include:

Pre-seed investment is down 32% from Q2; although, Carta expects that number could decrease some as additional transactions are recorded.

42% of Pre-seed rounds were for less than $250K.

40.3% of Pre-seed rounds occurred in California.

STV Take: This report makes it clear: Raising a Pre-seed right now is tougher than it’s been in the last two years. What I find interesting looking at the chart above is how Pre-seed investments, up until this quarter, have been on a solid upward trajectory since Q2 2023 while the broader venture market has been in a lull.

The number of Pre-seed rounds exceeding $1M also decreased in Q3. One possible explanation for this is that the large investments made in 2022 and 2023 into very early-stage companies have not gone as planned, making investors wary of similar bets. However, given that rounds >$1M are still happening, it’s clear some investors are still comfortable with these higher-risk deal dynamics, exacerbating the trend of the haves and have-nots at the Pre-seed.

🧭 A Guide to Optimizing Financial Performance

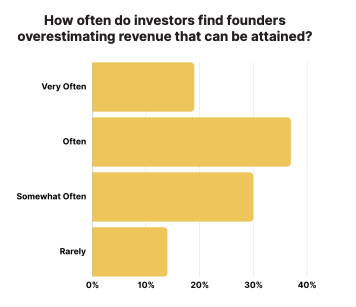

AVL Growth Partners released a new guide that highlights the key three financial drivers of a startup, along with recommendations to help founders avoid common financial modeling pitfalls and the best way to project business growth. A few of the common mistakes AVL Growth discusses in this guide include:

Overestimating attainable revenue

Misunderstanding how quickly revenue can grow related to COGs

Underestimating customer acquisition cost

STV Take: Investors understand that a company’s revenue expectations and growth projections presented in a pro forma are educated guesses at best and shots in the dark at worst. Investors can sniff out the latter. While uncertainty is inevitable regarding early revenue growth, there are techniques and best practices founders can use to generate a solid understanding of their cost drivers and present realistic expectations for potential revenue growth. AVL Growth’s latest guide offers valuable tips to help founders craft the best version of their pro forma. (Sponsored)

😤 Need Money to Build the Product but Need the Product to Get Money

A.T. Gimbel at Atlanta Ventures penned an article on a very common early-stage founder catch-22: the need for investment to build a product but the need to have a product before investors will invest. A.T. discusses workarounds founders can use to overcome this challenge. Some of his recommendations include figuring out a way to validate demand, such as a landing page with a sign-up form, and offering services manually to understand exactly the product that needs to be built.

“Know there are many different ways to break the stalemate here. It may not be the perfect path you want, but there is likely a path that you can keep moving forward.”

— A.T. Gimbel

STV Take: We have discussed this before, but it’s exceptionally rare to get investment dollars pre-product, but here’s the thing: having a built product isn’t a guaranteed path to investment, either. Investors are looking for great business opportunities and that usually comes from a ton of customer interactions and feedback. This is why I especially like A.T.’s first two points about validating demand and offering a service before actually building a product.

We’ve talked to too many founders who overbuild before recognizing that the product their market needs looks entirely different than what they have. Doing the hard work upfront to understand exactly which product capabilities are needed not only strengthens the case for investment but builds a solid foundation for a business.