Don’t Neglect Pitch Deck Design

This week we discuss the link between pitch deck design and storytelling, the problem with post-money SAFEs, and provide context on fund performance data.

Welcome to fall! We hope you are looking forward to lots of in-person meetings and events over the next couple of months.

🎨 Level Up a Pitch Deck with Design

In a short (four minutes!) YouTube video, the Deck Doctors discuss how to use basic design principles to improve the storytelling in a pitch deck. Specifically, they discuss how to use background color, layout variation, and information density (or lack thereof) to enhance the flow of a presentation.

“Punctuate with different levels of information density. If you have a dense slide, that takes a toll, and even if you have a lighter slide, light slides can get boring as well, so we want to have a balance between dense and less dense information…”

STV Take: It’s easy to let deck design be an afterthought, but part of the rhythm of the story is honed through the format of the deck. A pitch deck is no different than any other piece of collateral. In order for it to be effective, it needs to be engaging and direct. If it’s just bullet point after bullet point and/or contains too much information, there is a risk of losing a reader’s attention and having them miss the key elements of the pitch. An important point the Deck Doctors surface is that there should be variation in each slide’s information density. Inevitably, there will be complex topics that need to get addressed, but it can be helpful for readers to break this up with other slides that contain more digestible information.

✒️ A Proposed Fix for Post-money SAFEs

An article by Silicon Hills Lawyer describes how the current YC SAFE essentially gives investors extreme anti-dilution protection. It offers a small, one-line addition to help founders preserve equity should they raise additional capital on SAFEs in the future. The authors argue that this still provides investors with the needed clarity on how much of the company an investor owns at closing but ensures that dilution from future rounds that might be raised on SAFEs with higher valuation caps is shared evenly across investors and common stockholders.

“The hidden value proposition for investors of the post-money SAFE, and which has cost founders enormously by not understanding its implications, was an extreme level of anti-dilution protection built into the post-money SAFE. Any SAFEs or notes that you issue after the post-money SAFE round, but before a Series A, do not dilute the investors; they dilute only the common stock (founders and employees). This is the case even if the 2nd or 3rd round of SAFEs is an up-round with a higher valuation cap.”

STV Take: While this article is from December 2021, it’s as relevant now as it was then. This unspoken anti-dilution protection for investors on post-money SAFEs is a big reason why some founders are surprised to realize how little they own of their business once all of the SAFEs convert. Adding the language the authors recommend can help eliminate that unpleasant shock, but it’s always best to consult a lawyer well-versed in early-stage financings. Lawyers are expensive in the short term but a well-structured financing instrument can reap benefits in the long run.

🧭 A Guide to Optimizing Financial Performance

AVL Growth Partners released a new guide that highlights the key three financial drivers of a startup, along with recommendations to help founders avoid common financial modeling pitfalls and the best way to project business growth. A few of the common mistakes AVL Growth discusses in this guide include:

Overestimating attainable revenue

Misunderstanding how quickly revenue can grow related to COGs

Underestimating customer acquisition cost

STV Take: Investors understand that a company’s revenue expectations and growth projections presented in a pro forma are educated guesses at best and shots in the dark at worst. Investors can sniff out the latter. While uncertainty is inevitable regarding early revenue growth, there are techniques and best practices founders can use to generate a solid understanding of their cost drivers and present realistic expectations for potential revenue growth. AVL Growth’s latest guide offers valuable tips to help founders craft the best version of their pro forma. (Sponsored)

🤔 Context on Fund Performance Data

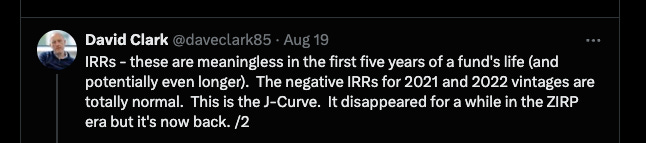

On X, David Clark provided some helpful thoughts on how to interpret Carta’s recent report on venture capital fund performance. It’s a short thread with the key takeaway being that venture is a long game. It takes 10-12 years for companies to go from origin to IPO and expecting material returns in the early years of a fund is unrealistic.

STV Take: There is a lot of doom and gloom out there about the state of venture funds, but I think understanding the nuances around fund performance metrics early in the life of a fund provides much needed context on the data. The run up in valuations in 2020 and 2021 was unusual, and for folks not familiar with the typical fund trajectory, it distorted how long of a timeline is really needed to realize outlier returns. That said, given that 2020 and 2021 were abnormal in the rapid increase of company value, I think an open question limited partners have for funds they’ve invested in during this timeframe is how much of the total value to paid-in capital (essentially the paper mark-ups) will materialize into distributions. Unfortunately, that will take time and will likely continue to hold back investments into new funds.