📈 Emerging Gen AI Revenue Benchmarks

This week we unpack the differences between a pre- and post-money valuation, new data on Gen AI startup revenue benchmarks, and a list of the best YC startup resources.

Greetings! We hope you’re having a great week!

💲Pre- vs. Post-money Valuation

I recently came across a GoingVC article that discusses the subtle but consequential differences between a pre- and post-money valuation. The article breaks down how pre-money valuation (company value before investment) versus post-money valuation (company value including the investment) directly impacts founder dilution and investor ownership percentages. It explains common mistakes both founders and investors make, including confusion over valuation terminology, overlooking option pool impacts, and failing to model convertible securities like SAFEs properly.

“Pre-money and post-money distinctions might seem small, but they influence ownership, dilution, and decision-making from day one. The best deals are clear, well-structured, and built on aligned expectations. When both sides understand the mechanics and model the impact, they create room for trust, growth, and long-term value creation.”

STV Take: Over the last two weeks, we have talked about the dangers of stacking SAFEs, and I think this GoingVC article is a good explanation of why those dangers exist.

GoingVC also mentions another term that is critically overlooked, the creation or expansion of an employee option pool. This is industry standard and should not be a red flag. However, during negotiations, it’s important for founders to remember that this option pool creation is usually done before the investment, meaning it dilutes existing shareholders and not the new investors.

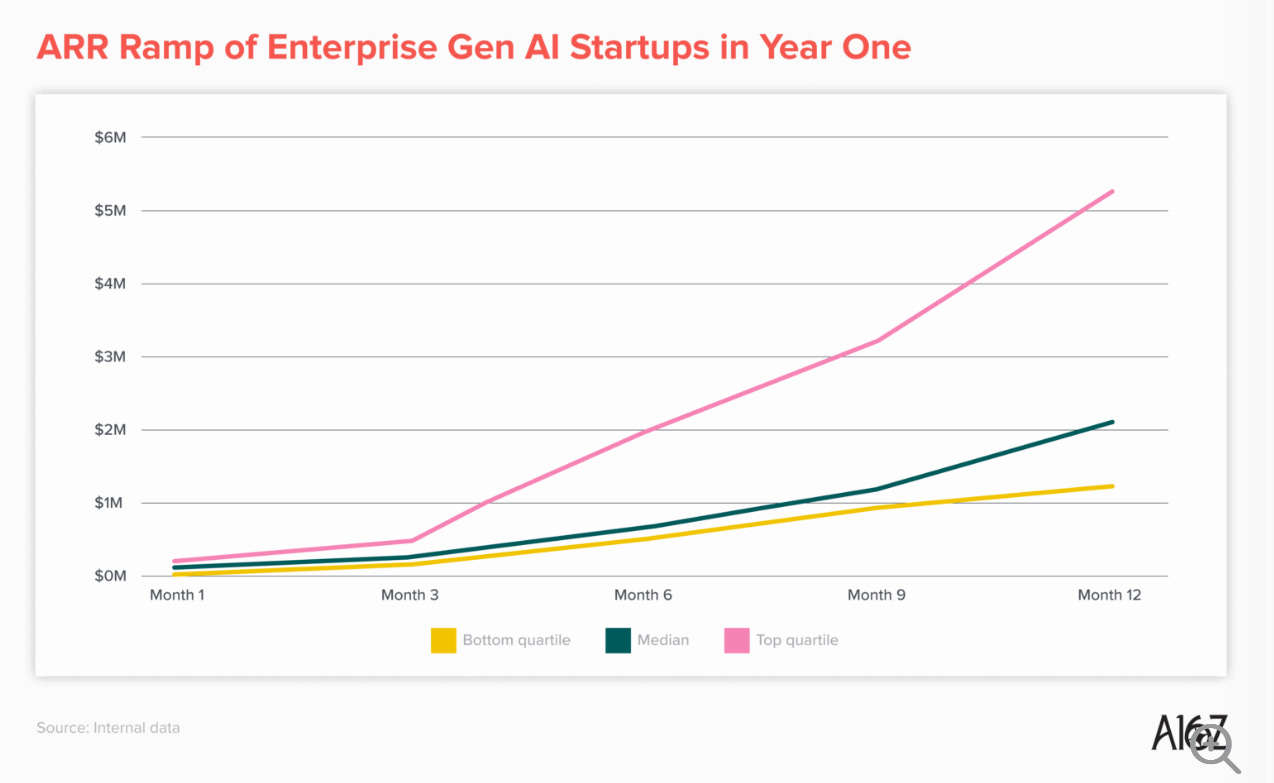

📈 Benchmarks for Gen AI Startups

a16z published an article showing the unprecedented revenue growth rates they’re seeing in both enterprise and consumer Gen AI companies. For enterprise Gen AI startups, the median revenue at month six of operating is $700K, and by 12 months, these companies are doing over $2.1M. Consumer Gen AI startups are seeing even quicker growth, with the median Gen AI startup generating $2.5M by month six and $4.2M in the first 12 months.

STV Take: First things first, I am not sure how representative a16z’s sample size is of the broader market, but there is definitely something here. It’s remarkable how many companies we have seen in the last six months that have scaled to hundreds of thousands in revenue in mere months. As the a16z team points out, speed is emerging as the only true moat in AI. I’ve talked to other investors about this lately and the speed top-notch founders are shipping product, growing revenue, and learning is unlike anything we have ever seen. There is something that feels remarkably different in founder conversations today versus those we were having even two or three years ago, and I think it comes back to how quickly things are moving and changing. For founders to stand out in this environment, they have to demonstrate their capability of moving fast. If a company is pre-revenue, the ability to ship product quickly or gather insights has to come across in any investor conversation.

📚 YC Content for Early-stage Founders

Ben Lang posted a compilation of YC resources that he finds particularly valuable for early-stage founders. His list includes robust guides on finding a cofounder, raising a Seed, and “Startup School” recordings on how to tackle the earliest parts of venture creation.

STV Take: Some of these guides are oldies but goodies—there is no need to reinvent the wheel on so many of these topics. For soon-to-be or recent founders, I highly recommend perusing these resources. They will save you a ton of time in the long-run.