Finding the Perfect Investor

This week we bring you advice for finding aligned investors, handling cold emails from investors (yes, it really does happen!), and new data from AngelList.

Greetings! We almost made it through January!

🎯 Investor Targeting

In a recent LinkedIn post, Jonathan Crowder, a partner at Intellis Capital, discussed the importance of investor targeting when fundraising. He argued that identifying and pitching to the right investors is just as crucial as having a compelling pitch deck. Crowder's reasoning is that a pitch deck is ineffective if it's not seen by potential investors who are a good fit. Since it can be hard for first-time founders to know how to meet the right investors, he provided guidance on how to find and establish relationships with them.

STV Take: Personalized outreach is a critical success factor for founders early in their fundraising journey. It might be easier to load emails into a mail merge and hit send, but the likelihood of those converting into first conversations is so incredibly slim. Investors have to apply some type of filter to the companies they take first calls with, and they’re more likely to send an email straight to trash if nothing stands out. As Jonathan notes, including a couple of bullet points in the email that help demonstrate momentum with the business can go a long way in getting the right investor’s attention. Lastly, a VC Minute tip (episode 30): Please, don’t ask if you can send the deck. Just attach it.

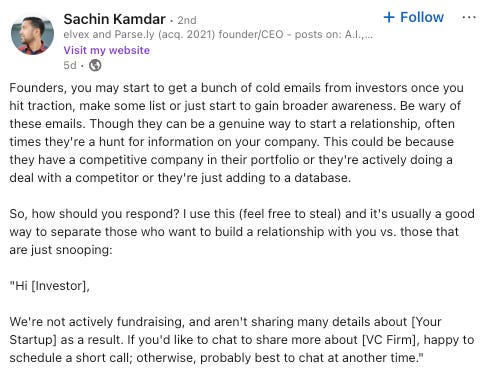

🥶 Cold Emails… from Investors

At some point, usually after the announcement of a first round of funding, the cold email flow reverses and founders find themselves on the receiving end. Many of these will be from genuine folks looking to build a relationship in hopes there is an opportunity for them to invest at a later round, but every now and again, you’ll come across a bad actor. Sachin Kamdar, founder of elvex, provided advice and an email template to guide founders on how to weed out folks who just might be fishing for information.

STV Take: While every founder needs to decide what's best for them, I'm a big fan of Sachin's approach. He takes the focus off the business specifics and puts it back on building a relationship with potential investors, while also eliminating those disingenuous individuals. This can ease the pressure and lead to a more authentic conversation that can help decipher whether the investor could be a good partner.

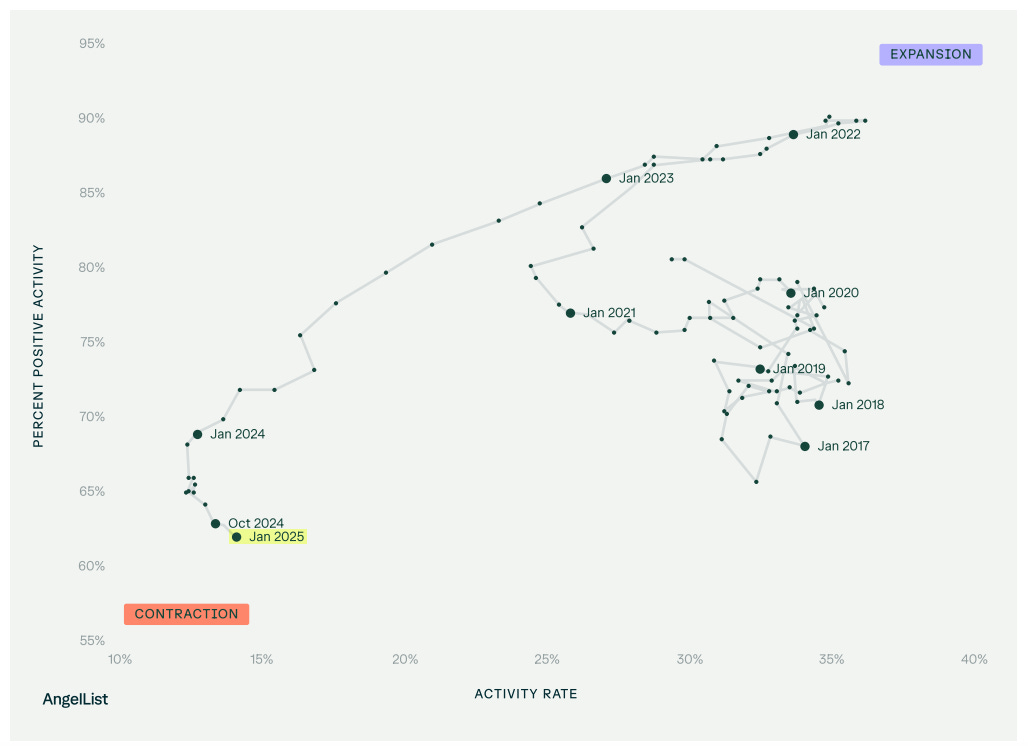

📄 State of U.S. Early-stage Ventures & Startups 2024

AngelList released their latest annual report discussing the trends in early-stage venture. In it, they include data on the frequency of markups, fund benchmarks, and other startup market data. Some interesting tidbits of data from the report include:

The median pre-money valuation of a Seed round was $20M in 2024 compared with $10M in 2019.

32% of Pre-seed and Seed-stage deals were labeled as AI or machine learning.

Median valuations at the Series A increased by 27% to $62.5M compared to 2023.

STV Take: There is some really interesting analysis in this report. One of the sections discusses why Seed round valuations have increased so significantly, attributing part of this rise to the change in nomenclature. In other words a Seed round of ten years ago actually looks more like a Pre-seed round today. The other intriguing explanation offered is inflation. Founders have to pay more for everything, including employees, which increases the amount of capital needed. It begs the question: Will AI reverse this trend?

AngelList is also in a unique position to provide data on the performance of emerging managers. According to the report, most of the managers who use AngelList are on funds one through three. Similar to all managers, this group is struggling to get liquidity. Unfortunately, unlike more established managers, emerging managers don’t have the track record of distributions from prior funds, meaning raising new funds continues to be a challenge.