Metrics that Matter

This week we are featuring insights into VC fund math, the new metrics investors are scrutinizing, and intel on Seed rounds.

Greetings & Happy Halloween 🎃 / Dia de los Muertos 💀

➗VC Fund Math

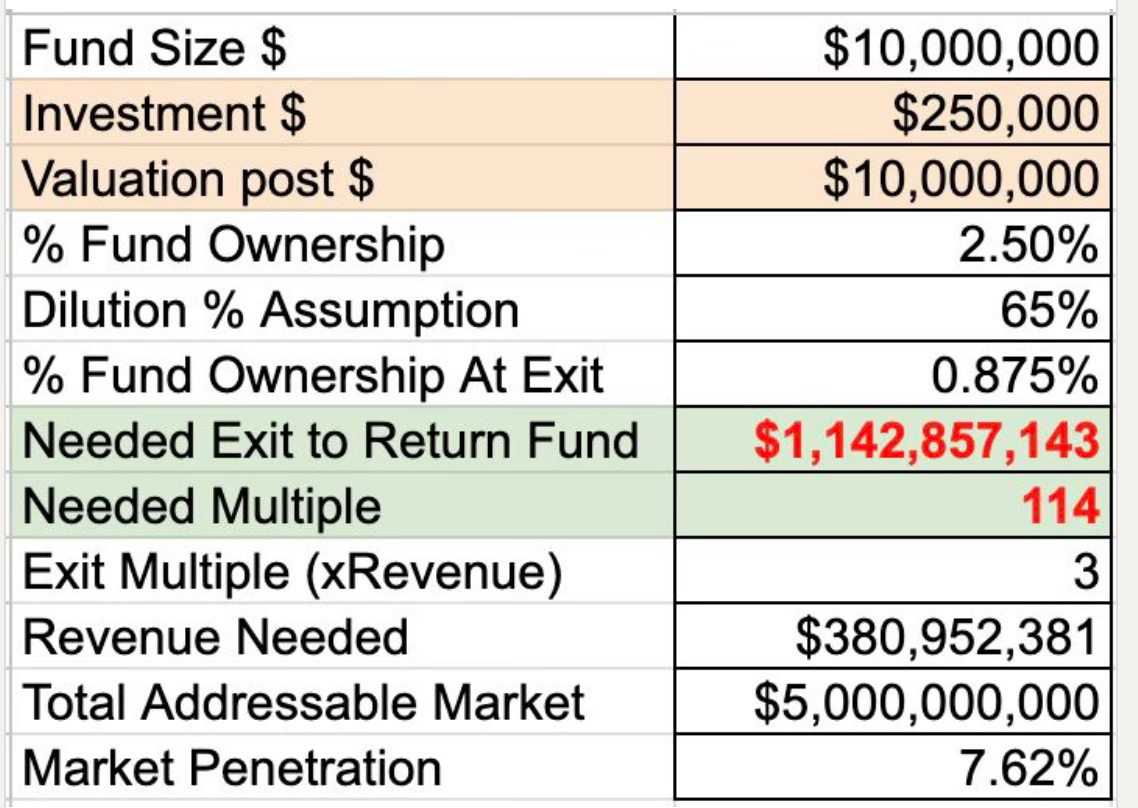

Mayur Aras had a great LinkedIn post walking through the math that VCs must do to justify an investment. For every check, a VC has to understand how it has the potential to return their fund. This is why VCs care so much about the addressable market. If a market is too small, then a company can’t hit the revenue threshold it needs to get an exit value that generates a >100x return, which is what is needed in the example he gives.

STV Take: This math is critical for any founder raising venture capital to truly understand. As Mayur points out, VCs are generally expecting a company to achieve that level of growth within the 10-year lifespan of their fund, which is no small feat. This is why not every business is a fit for venture capital. Most simply can’t scale fast enough or big enough to hit the types of exits VCs need to make their portfolio math work.

A common reaction is: “Why don’t VCs just back more businesses that can reliably triple?” The truth is, venture returns don’t work linearly. Many companies, even the ones that look like a safe bet, fail outright, so investors rely on a few outliers—the fund returners—to make up for the losses. That’s why when VCs press on market size or your path to $100M+ in revenue, it’s not nitpicking, it’s survival.

🧐Two Metrics that Matter to Investors

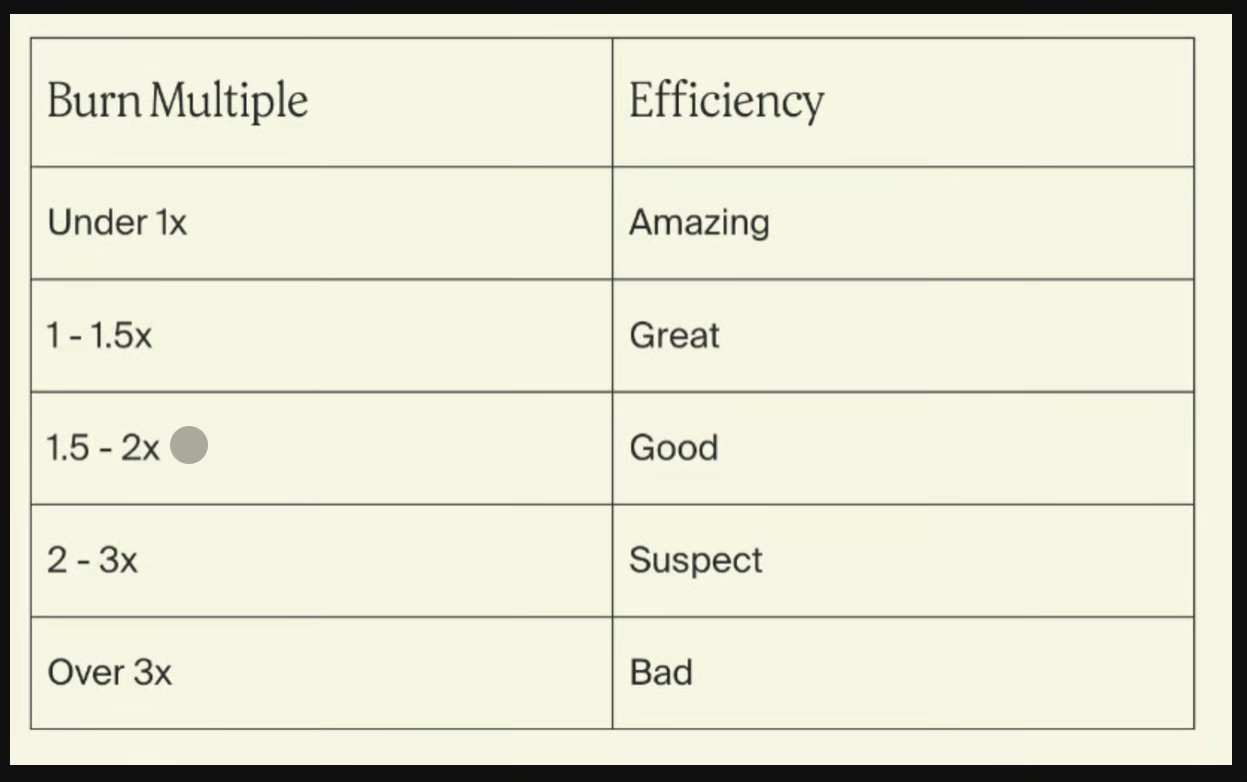

Andre Retterath at Data Driven VC penned an article on the two metrics that investors are watching closely these days, burn multiple and revenue per dollar raised. Essentially, each of these metrics helps investors understand the capital efficiency of a business, which, as the author points out, is critical as capital has become more expensive and harder to get. Some of the data the authors highlight:

By Series A, good companies usually have a 1.2x burn multiple, meaning that for every $1 of revenue, a company is burning $1.20.

$2M in ARR is now seen as the minimum revenue needed to raise a Series A.

AI startups are reaching $5M in ARR in a median time frame of two years.

STV Take: I’ll start by saying there are always exceptions in venture financing, but this article serves as a stark reminder of how difficult it is to navigate from Seed to Series A. The metrics it highlights—burn multiple and revenue per dollar—help explain why there’s no “magic number” of revenue you need to raise a Series A. It’s more complex than hitting a revenue threshold, and founders should be ready for more intense scrutiny of capital efficiency than ever before. Ultimately, raising smarter, not just faster, is what separates the startups that scale from those that stall.

🕵️Seed Round Intel

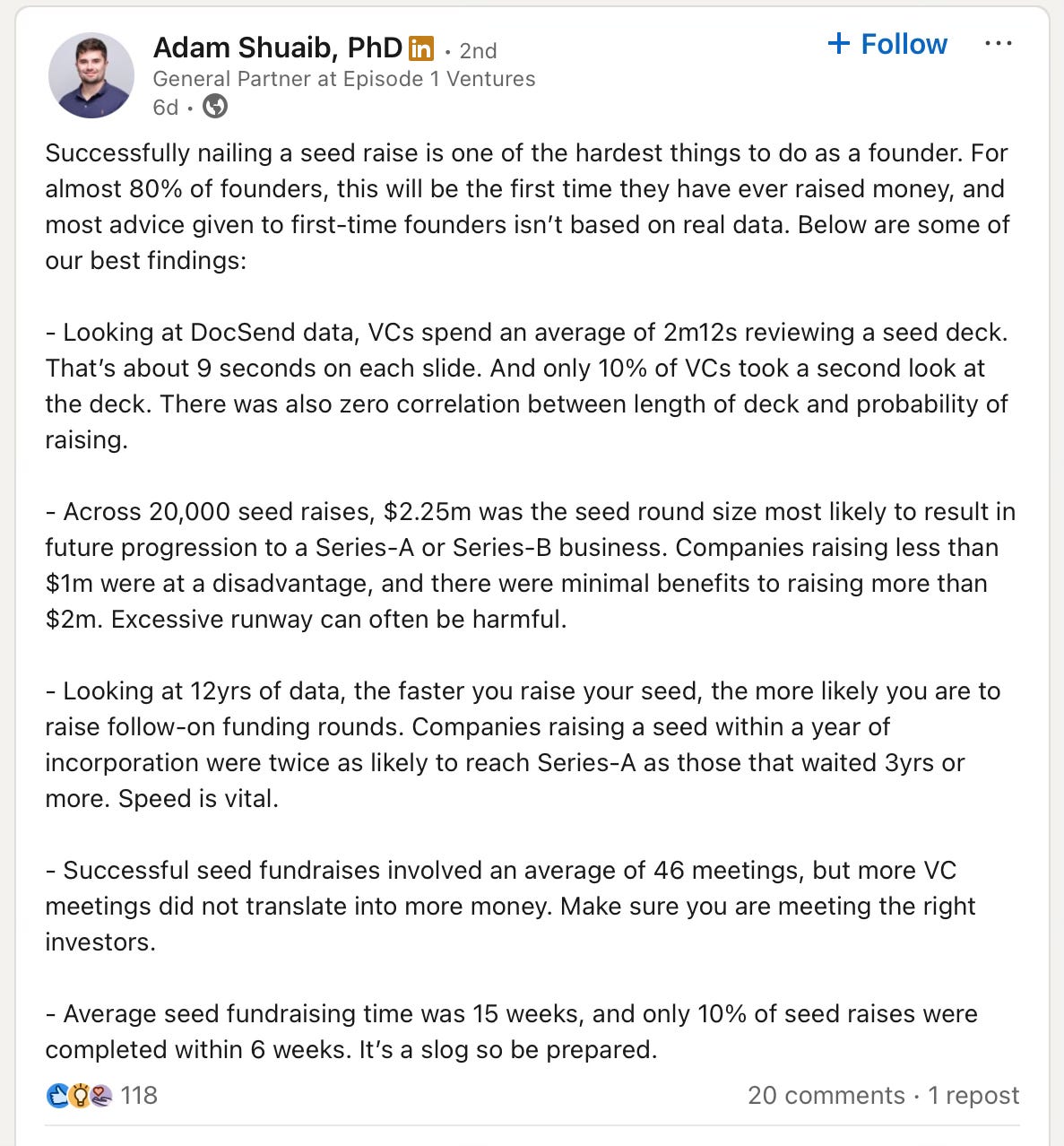

Adam Shuaib, General Partner at Episode 1 Ventures, highlighted five of the best stats he has come across on Seed fundraising dynamics. See below!

STV Take: This data confirms what many first-time founders miss: Speed signals momentum and the $2.25M sweet spot exists for a reason (less leaves you undercapitalized, more creates valuation traps and masks weak product-market fit). The most actionable insight: front-load investor qualification to build a tight list of 20-25 thesis-aligned funds before you start, because 46 meetings is the average but quality beats quantity every time. Plan for 15 weeks but optimize for six to eight by creating genuine urgency through progress, not artificial deadlines.

While speed to raising a Seed round does appear to increase the odds of raising a Series A, it’s important that founders validate VC is the right path for them. As the first post in this article highlights, the type of growth VCs want to see is steep. Take the time to do the work to validate that the business can grow like investors want to see. It will save so much time and headache later on.