Minimum Viable Test > Minimum Viable Product

This week we highlight new private SaaS company growth rates, the different phases of GTM success, and how minimum viable testing can help validate early startup ideas.

Greetings! If you’re in the eastern part of the U.S., we hope you’re surviving this heatwave. 🫠

Quick programming note: We’re pausing this newsletter for the next three weeks due to the 4th of July holiday, a vacation with the family, and our team offsite. We’ll be back in your inboxes on July 23rd. Hope you enjoy some fun summer activities between now and then!

📊 Private SaaS Company Growth Rates

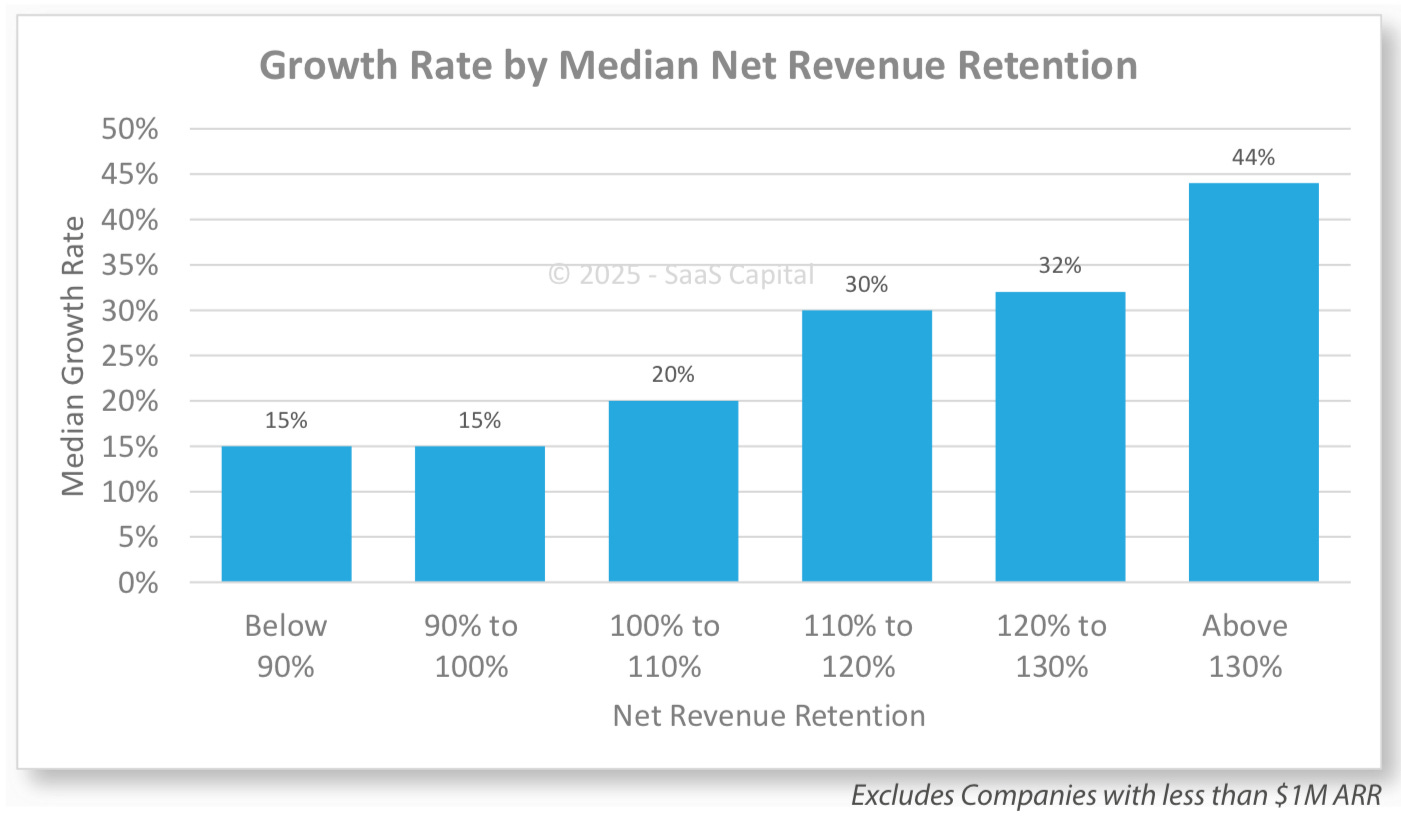

SaaS Capital released their annual report featuring survey data from over 1K private B2B SaaS companies. It reveals that median growth rates have declined to 25% in 2024, down from 30% in 2023. As one might imagine, growth expectations vary significantly by company size, with smaller companies under $1 million in ARR needing 40% growth to hit median performance while larger companies doing above $20M in ARR need 20% growth to achieve the same benchmark. Only 6.9% of surveyed companies reported flat or negative growth, indicating that while growth has generally slowed, the vast majority of private SaaS companies continue to expand at positive rates.

STV Take: One of the compelling findings in this report is how net revenue retention drives growth. For founders seeking investment, the growth data in this report offers a reality check: investors often expect revenue to triple annually, specifically early on, but that kind of growth is rare. It gets even harder to achieve if a company is churning customers or not taking the time to upsell existing customers. To hit investor growth expectations, keeping and expanding opportunities within a company’s current customer base should be a key priority.

⚾ Hitting the Venture Home Run

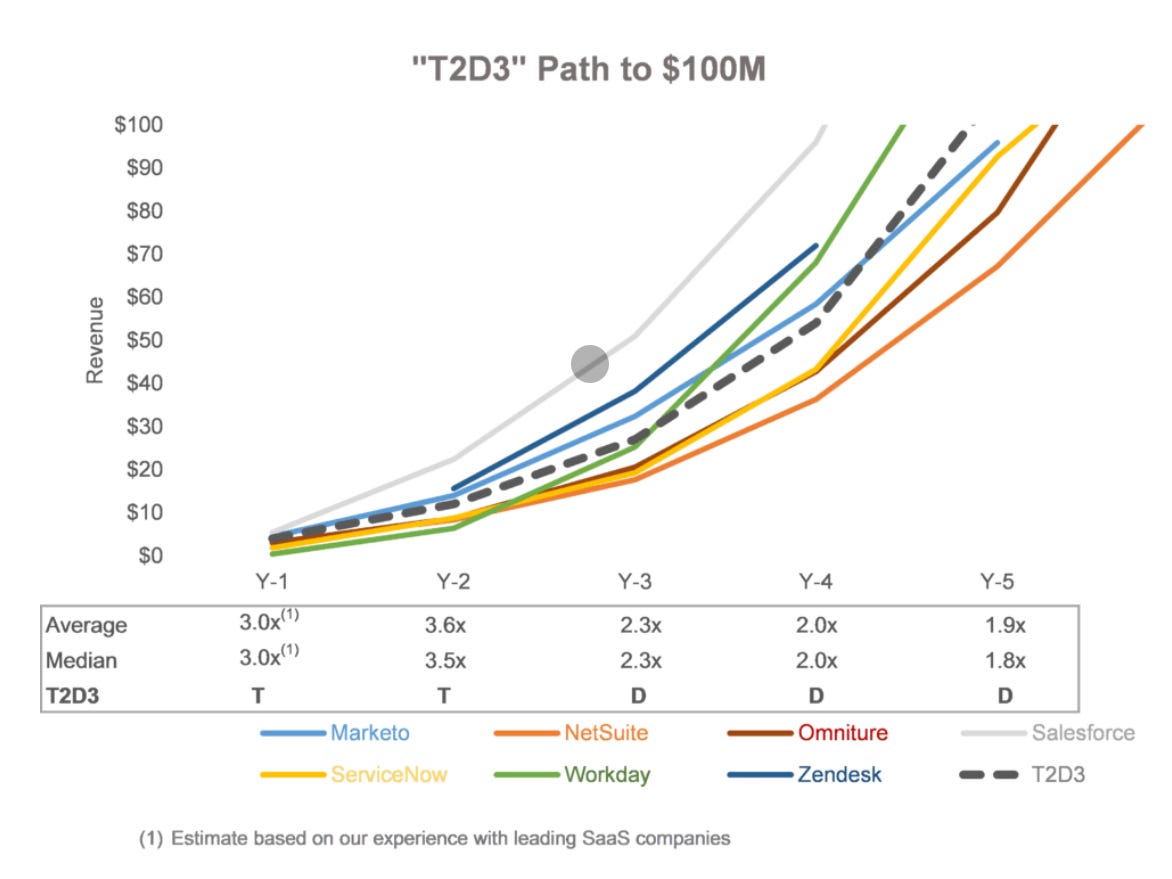

A good follow up to the above report is this Battery Ventures’s article that breaks down the following seven phases of go-to-market success for SaaS companies:

Establish product-market fit: This first phase is all about finding a specific pain point that is consistent across a company’s target customer base.

Get to $2M in ARR: It can take a year or two to get here, but during this time, the founders should still be the ones closing the deals. The goal during this phase is to hone the sales pitch and funnel strategy.

Triple to $6M in ARR: While occasionally you’ll have what the author calls a “hero” founder, this phase is usually when companies start thinking about building a scalable “sales machine” and hiring sales team members.

Triple to $18M in ARR: At this point, companies can expect renewals and referrals to help revenue growth. This is also the time when many companies bring in a VP of sales.

Double to $36M in ARR: The sales teams gets larger, and if applicable, international expansion starts to be planned.

Double to $72M in ARR: This is where operational challenges become very complex and considerations around team growth and partner challenges pop up.

Double to $144M in ARR: You’ve potentially arrived at the $1B valuation, but things are just getting started. If going public is the chosen route, 90% of the value of the top performing public companies has been created post-IPO, as the author points out.

STV Take: This framework is really helpful for understanding the types of growth challenges founders should be conquering at each stage and can be useful to use in creating a fundraising roadmap. In an investor’s evaluation, they aren't just assessing revenue growth but whether a founder has built the right foundation to reach the next milestone and ultimately build a sustainable business. This explains why "hiring a sales lead" as a primary use of Seed funds often makes investors nervous. Founder-led sales creates the tight customer feedback loop necessary to create a strong, repeatable sales process. VCs know that premature scaling—like hiring sales reps before you've proven the sales motion works—is one of the fastest ways to burn through capital (and time) without meaningful progress.

✏️ Minimum Viable Test

Gagan Biyani co-authored an article for First Round Capital that discusses his approach to validating a startup idea, called the “minimum viable test” (MVT). He proposes that before founders get locked into assumptions about what a product “should be”, they should focus on testing the riskiest assumptions of the business that will lead to success (or failure). By doing this, founders gain a stronger sense of the exact problem they’re solving for target customers and the vision for the product.

“The whole point of the MVT strategy is to give you more confidence so that you can forego short-term growth for long-term growth. Run a number of MVTs, create a product vision, and then execute on that vision while getting feedback from your customers.”

STV Take: A common mistake we see founders make is overbuilding on the product before founders have done much customer validation. An amazing product won’t get a company far if it doesn’t also solve a very real, very deep problem. The MVT strategy can suss this out and help founders develop a deeper understanding of the target customer. It might feel counterintuitive to hold off on building a product at the earliest stages, but when founders take the time to truly understand their customers’ needs, it increases the odds of their success and enables them to potentially go further faster. That’s why investors highly value founders that are so in tune with their market.