Q1 2025 VC Fund Performance Data

This week we are highlighting the latest data on VC fund performance, the downside of venture-scale thinking, and advice on how to handle strategic partners.

Greetings! Feels like we are in a full sprint before things slow down a little after the 4th of July!

📘 Q1 2025 VC Fund Performance Data

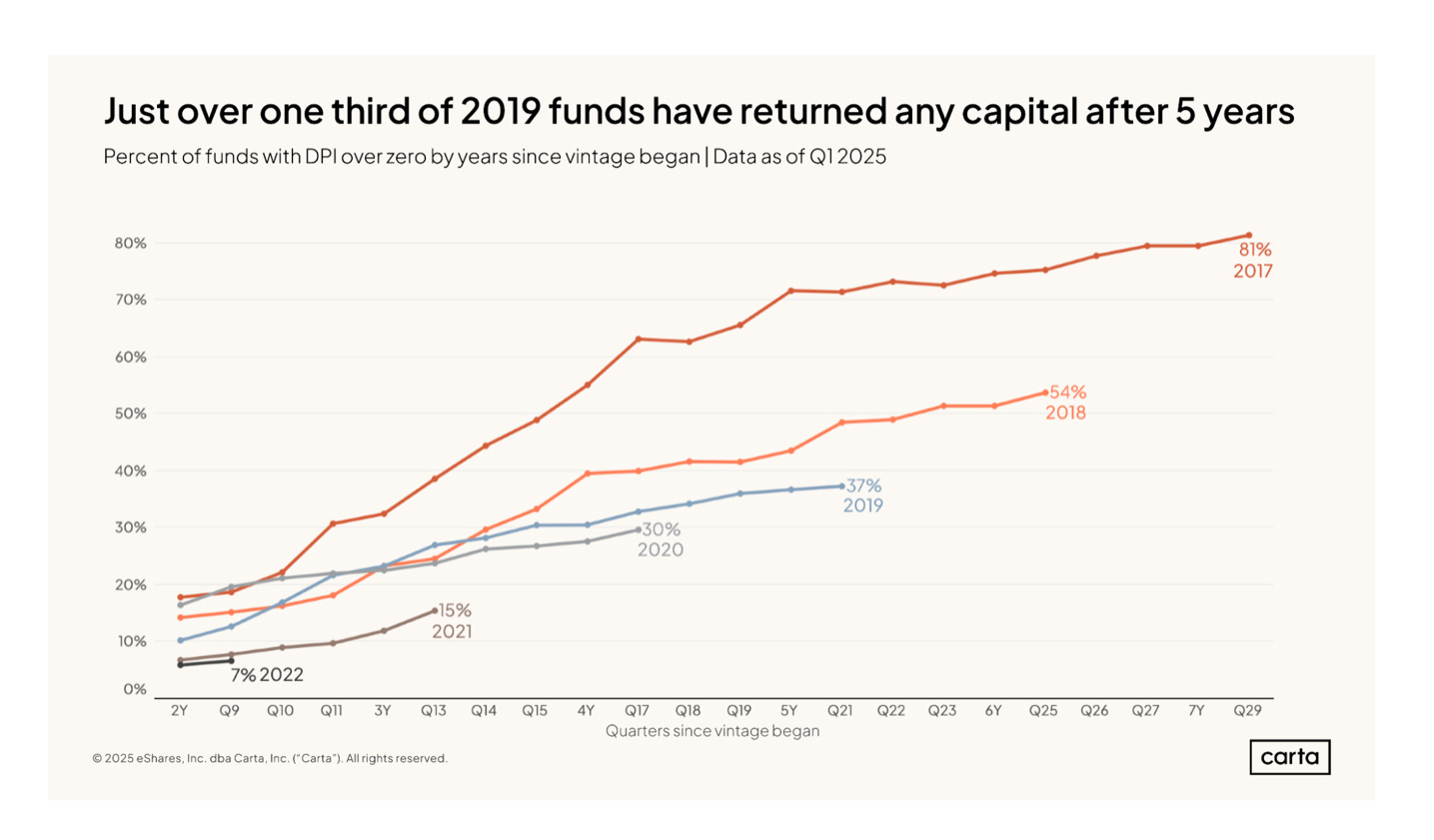

Carta released their latest report on fund performance. To anyone in the venture ecosystem, it won’t be shocking to read the big takeaway, which is that the lack of liquidity in venture persists. In other words, funds aren’t returning capital to their investors. A rather shocking stat from the report: 46% of funds that started deploying capital in 2018 have no DPI, meaning they’ve returned $0 to investors.

STV Take: This illiquidity has big ramifications across the ecosystem. If funds aren’t able to distribute proceeds to their investors, those investors have less to allocate to new funds, limiting the amount of capital available to new startups. The good news is that there have been several recent IPOs that could be signaling an end to the liquidity drought. Unfortunately, many are being valued at less than their last private round, so it’ll be interesting to watch how this trend continues and the impact it has on startup valuations across stages.

💀 When Venture Thinking Kills Your Startup

Donna Harris at Builders + Backers argues that the myopic focus on raising venture capital is hurting founders and their businesses. She argues that raising before a founder actually proves they can make money is reversing the process of how it should be. Founders should not raise to figure out the business. Instead, they should take on venture capital to pour fuel on something that is already working. At the end of the article, she makes recommendations to founders on how to reset priorities to best position themselves to actually build a durable business. The first one? Talk to customers first.

“Stop optimizing for pitch decks and start optimizing for customers. The best businesses—whether funded or not—are built by entrepreneurs who understand that customers, not cap tables, are the foundation of everything else.”

STV Take: Every person starting their founder journey should read this article—it will save so much time. Too often folks obsess over a pitch deck and the narrative around the fundraise, but the harsh reality is that no amount of pitch improvement will sway an investor quite like early customer validation. Sure, there are founders out there that are exceptional fundraisers and have raised money with no product or validation, but that’s truly the exception. For most founders, they’re wasting valuable time pitching investors when they should be pitching customers.

☢️ Not so Innocuous Terms

Crunchbase shared an article about a founder who signed a contract with a commercial partner that gave this partner warrants and included a requirement that the company notify this partner 90 days before any financing event or M&A. While it didn’t seem like that big of a deal at the time, it caused potential acquirers to cease acquisition conversations once they found out about this clause. In retrospect, the author argues that the founder should have negotiated for a shorter window for this partner to review, or ideally, not included this clause as part of the deal at all.

“Legal clauses meant to align incentives can become structural obstacles. It is critical to design them with an eye toward long-term returns for you and your shareholders.”

STV Take: Getting a strategic partner on board early can be both a blessing and a curse. In many cases, it bolsters the credibility of the company and provides real validation of the business potential that can be a great signal to other companies and investors. The challenge, though, is making sure these groups don’t have too much control or non-standard information rights. Too much of either can create challenges if an acquisition opportunity arises and/or potentially spook the partner’s competitors away from wanting to work with the startup. That said, we typically don’t see issues with founders raising small checks from strategics at the Seed round, as long as the terms are standard across the investor base and for the market.