Q1 ‘25 Venture Activity

This week we cover Q1 ‘25 venture activity, Southeast (U.S.) investor sentiment, and non-dilutive funding options.

Happy Hump Day!

🖊️ The State of Private Markets

Carta released their latest report covering venture activity in Q1 2025. Probably unsurprising to this audience, there were both fewer Seed deals and fewer dollars invested at Seed than Q1 2024. The silver lining is that those companies that are able to raise money are doing so with less dilution.

STV Take: The bifurcation of those that can raise funding and those that can’t (Hot or Not) is not limited to the Seed round—the number of transactions from Seed rounds to Series B rounds is down. One of the points Carta makes is that this is because we’re still dealing with the hangover from ‘21 and ‘22. I said this last year, so take it with a grain of salt, but I think the washout of companies that raised in 2021 and 2022 that haven't been able to grow at venture pace is coming.

💸 Non-dilutive Funding Options

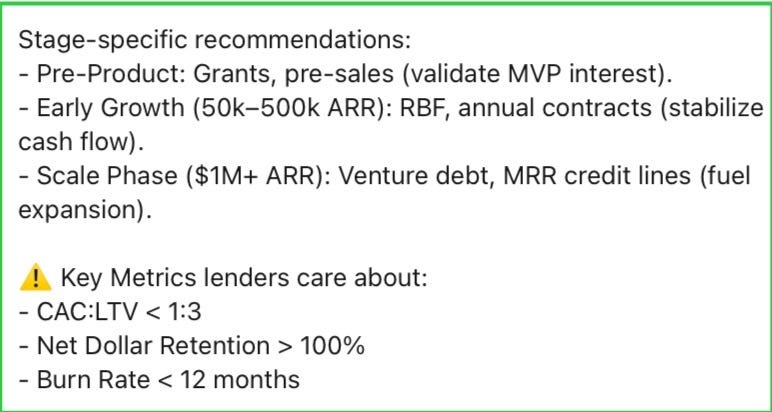

As the Carta report reiterates, it’s tough to raise early-stage funding. Naturally, that leads a lot of founders to wonder what their alternatives are to raising venture capital. Karin Boussedra posted a good list of options for non-dilutive funding sources for early-stage companies, along with the pros and cons of each potential funding source.

STV Take: Admittedly, some options on this list are out of reach for certain companies, but this list is a concise primer on the different options out there. Giving up equity in the earliest days is usually the most expensive, so it can be worth exploring alternatives to equity-based financing, especially if it isn’t clear whether the business is a good fit for venture capital. These resources can also be helpful for founders in between rounds that need to think about how to extend their runway and ensure they can hit the next milestones without doing a bridge round.

🔮 Southeast VC Pulse Survey

Front Porch Venture Partners, a firm that invests in other venture capital firms and early-stage companies in the Southeast U.S., released results from their survey of investors located in the same region. The goal of this survey was to establish a “Southeast VC Confidence Index” that indicates how fund managers are feeling about raising another fund and investing in new companies over the next twelve months. Again, not surprising to read that most investors are sort of “meh” about the next 12 months, not supremely confident but also not totally bearish.

“Anybody who is really in the flow of information in venture knows that flat, bridge and down rounds have become far more common than exits and up rounds since 2021. ‘We've had some good exits and also I think some down rounds that I don't love on paper, but I think will help the company get to a better outcome over time.’”

STV Take: Because so much venture activity happens in NYC or SF, it is rare to see data coming exclusively from areas outside of those hubs, which is why I thought this report was an interesting one to highlight. It reinforces the notion that venture rounds are being redefined across the country. No matter where you are in the U.S., it appears that Seed investors are deploying capital at earlier stages, while the bar for raising a Series A is getting higher.

I think this trend comes back to the residual hangover from ‘21 and ‘22. There are many companies at the Seed stage right now that have raised so much money and haven’t hit significant revenue milestones. Investors are finding it easier to either go earlier to those companies without as much funding history baggage or go later to weed out the chaff.