The Evolving Pre-seed & Seed-stage Landscape

This week we bring you insights on the growing gap between Pre-seed and Seed funding, what early-stage investors look for, and a how-to on prepping for a fundraise.

Greetings! Hope you’re having a great week!

🧗🏾 The Gap Between Pre-seed and Seed

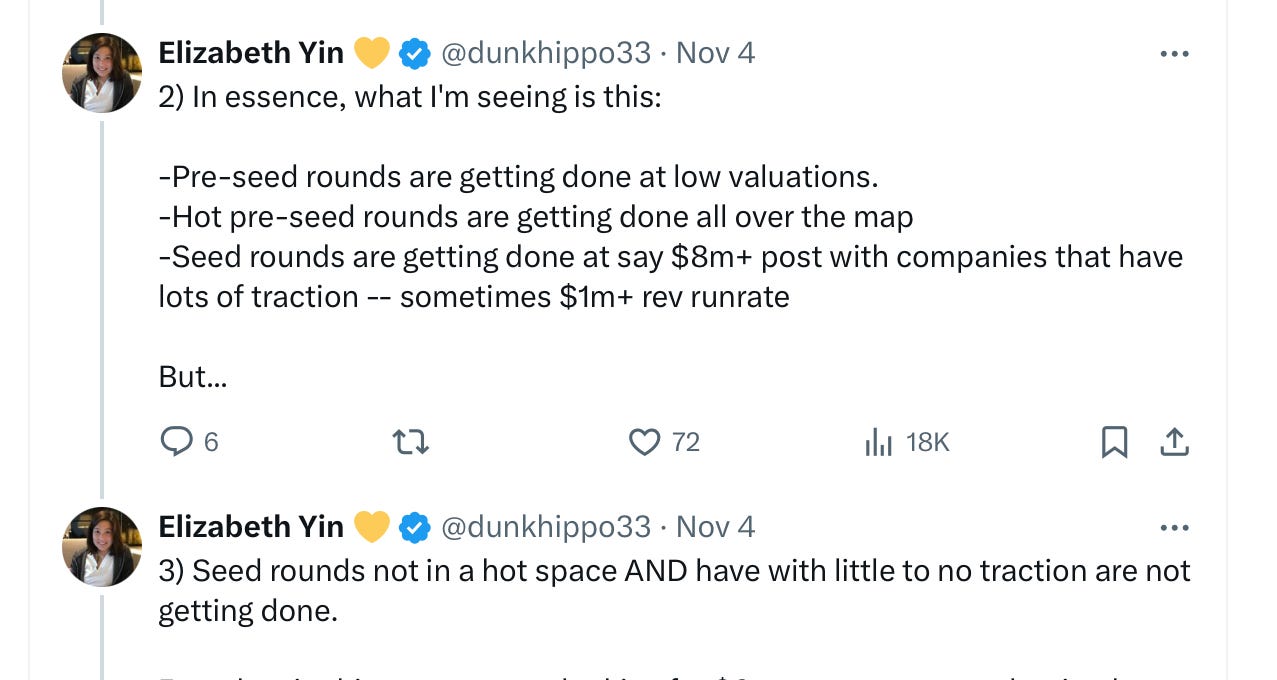

Elizabeth Yin, Co-founder & General Partner at Hustle Fund, posted a thread on X discussing the changing dynamics at Pre-seed and Seed. The main takeaway is that raising a Seed round has gotten harder and is virtually impossible without meaningful traction. As Series A investors have raised the bar, so too have those at Seed. According to Elizabeth, it’s now common to see Pre-seed rounds being raised with the expectation of getting that company to around $50K in monthly revenue.

STV Take: One of the observations Elizabeth makes is that she is seeing companies doing six figures in revenue that are not able to raise Seed rounds. While no reason is offered in this thread, I personally think this is happening for two reasons, competition and smaller market sizes for these companies. On the former, there are certain categories that got oversaturated during COVID. These categories now have companies that have raised significant amounts of money and captured meaningful market share, making it hard for newer entrants. Even with a couple of hundred thousand in revenue, without groundbreaking differentiation, investors will look at the opportunity as one with a capped upside because it’s so unlikely they’ll be able to outcompete companies that are much further along.

The other reason, small market size, is typically a result of an investor not seeing a path for a company to scale in a way that generates a venture outcome. It could be for a variety of reasons; e.g., a belief that customer acquisition costs will be too high or that the solution is really only fit for a small segment of a market. Some of these businesses can still be great for founders but venture capital might not be the right path to capitalize the company. In that case, transitioning to focusing on selling to customers and not investors is paramount, as Elizabeth notes.

🎯 What VCs Want

In a publicly aired video of a panel at TechCrunch Disrupt, three Seed-stage investors—a multi-stage investor, an emerging fund manager, and a founder/angel investor—discuss what stands out for them when making investment decisions. The discussion starts with defensibility around AI and the critical role it will play in all businesses, not just those that are building new models. The last half of the conversation then turns towards how the investors add value to portfolio companies and the most important things founders must answer in the initial pitch.

“I’m looking for founders who have an intellectual honesty, who say look, I don’t have the answers. Because transparently, if you ask an investor if they have the answers and they tell you that they do, they’re probably lying.”

- Chelcie Taylor, Investor, Notable Capital

STV Take: Every now and again, I’ll talk to founders who are worried that bootstrapping a business will set them up for failure if they decide to raise venture capital in the future. The end of this discussion should assuage those concerns. All three panelists had no bias against this. In fact, it was quite the opposite; they believed it showed resilience and an ability to execute. The important piece is recognizing when the market timing is most favorable and when potential growth is being sacrificed because of capital constraints. That’s usually when it’s time to consider venture as a potential financing path.

🧭 A Guide to Optimizing Financial Performance

AVL Growth Partners released a new guide that highlights the key three financial drivers of a startup, along with recommendations to help founders avoid common financial modeling pitfalls and the best way to project business growth. A few of the common mistakes AVL Growth discusses in this guide include:

Overestimating attainable revenue

Misunderstanding how quickly revenue can grow related to COGs

Underestimating customer acquisition cost

STV Take: Investors understand that a company’s revenue expectations and growth projections presented in a pro forma are educated guesses at best and shots in the dark at worst. Investors can sniff out the latter. While uncertainty is inevitable regarding early revenue growth, there are techniques and best practices founders can use to generate a solid understanding of their cost drivers and present realistic expectations for potential revenue growth. AVL Growth’s latest guide offers valuable tips to help founders craft the best version of their pro forma. (Sponsored)

💭 Pitch the Way VCs Think

Over the weekend, I rediscovered Vinod Khosla’s overview on how founders should think about pitching investors. The 73 (!!) slides are filled with pointers to help founders nail the pitch development process and be more prepared when they start meeting with investors. Whether it be in the storytelling or deck design, the overarching takeaway is to be simple and clear.

STV Take: The point above about “steer[ing] into investor’s concerns” rather than avoiding them is critical. Competition is an area where I see this manifest a lot. Too often founders gloss over their competitors, thinking it is a terrible sign if there are other companies solving a similar problem; however, it actually validates the opportunity. The red flag for investors comes when it’s not clear that the founder understands the competition. It can signal a poor understanding of the market. If you're building in a competitive space, address this directly. Then build credibility with investors by highlighting what you think your company’s competitors are doing (or have done) wrong and where your unique insight is.