The Metrics Needed for a Series A

This week we are bringing you new data on what it takes to raise a Series A, the significance of a clean cap table, and the signals that will cause a VC to decline an intro call.

Greetings! Regardless of how you feel about Valentine’s Day, I hope you take a moment to enjoy the best thing about it, chocolate!

Updated Series A Metrics

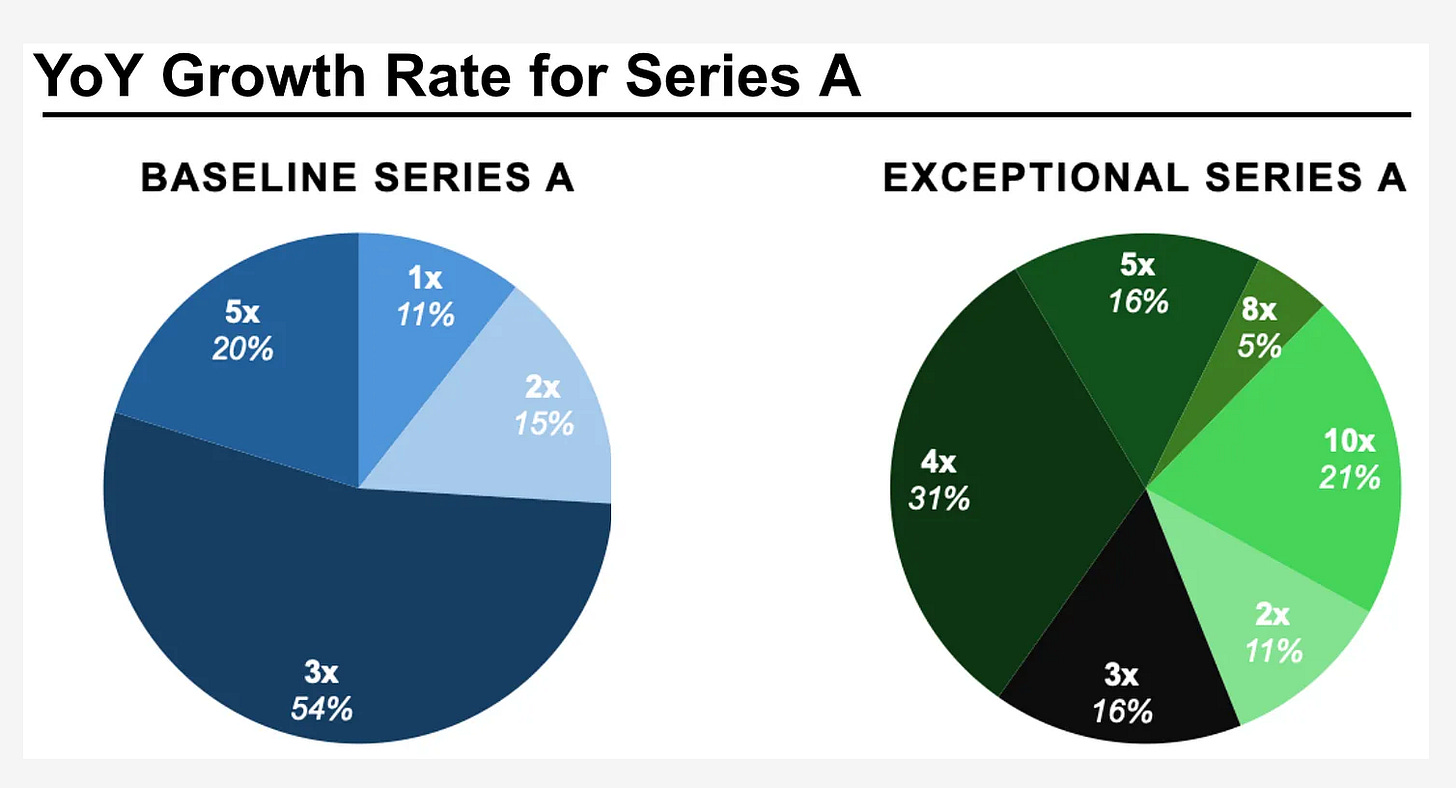

Daniel Chesley, a principal at Work-Bench, published the results of his survey which asked 30 different investors to identify the current metrics needed for companies to raise a “baseline” and “exceptional” Series A. It shouldn’t come as a shock that the bar is high. To raise a standard Series A, the majority of investors surveyed think a company needs to have $1M to $1.5M in annual recurring revenue (ARR) and have at least 3x year-over-year (YoY) growth.

STV Take: As the author notes, tripling revenue from $100K is quite different from tripling revenue at $1M. My hunch is that many of the mature Seed-stage companies that haven’t raised a Series A likely haven’t done so because their growth just isn’t at the velocity venture investors need to see. This part is absolutely critical. Getting to $1M in ARR is no small feat but the time (and capital) it took to do that really matters. Investors know customer acquisition usually only gets tougher over time. If early growth is slow, investors will doubt the company's ability to accelerate revenue growth. Founders in a situation with less than ideal growth should prioritize profitability or, if capital is necessary, have a compelling reason for why revenue growth will accelerate now.

🧼 Why Clean Cap Tables Matter

In a recent LinkedIn post, Brett Brohl, Managing Partner at Bread & Butter Ventures, explained why early-stage investors prioritize founders' ownership. While founders may feel motivated by their current equity, early-stage investors are aware that later-stage investors need assurance that founders remain incentivized by a substantial stake in the company. If later-stage investors perceive insufficient founder equity and motivation, they may "recap" the business, establishing a large equity pool that significantly dilutes early-stage investors' holdings.

STV Take: Early-stage investors accept a variety of risks, but a messy cap table is typically not one of them. Although it's technically possible to rightsize founder ownership at the Seed stage, few investors are willing to take it on. It is a hard, thankless job that often leads to dilution of the earliest investors, potentially creating conflict and animosity with the folks who took the biggest risk. Not a great way to start a relationship.

As we have discussed, valuation is a balancing act. Raising at too high of a valuation can make future financing difficult if the business doesn't grow into the prior round's valuation. Conversely, too much founder dilution early on is problematic, as investors are hesitant to take on the burden of cleaning up a messy cap table.

⚠️ Sending the Wrong Signal

Ever wonder how VCs can parse through the dozens of decks they see in a week? It’s because they rely on patterns and “signals” in the deck that enable them to make a quick judgement on whether they should take an intro call. OpenVC sheds light on these and provides insights into why they’re a dealbreaker for most investors. A couple of ones that resonated with me include the following:

“We have no competition.”

“You ask for a NDA before sending your deck.”

“Your market sizing is top-down rather than bottom-up.”

STV Take: The common thread across most of these is that it signals a founder hasn’t done enough work to understand the market or the process of when, why, and how to raise venture capital. The good news, though, is that most of these are within a founder’s control. Yes, addressing these issues will take time, but the business will come out stronger.