The State of Pre-seed in Q1 2025

This week we bring you fresh data on Pre-seed funding, (more) SAFE advice, and a behemoth AI trends report.

Greetings! We are halfway there!

🔖 State of Pre-seed: Q1 2025

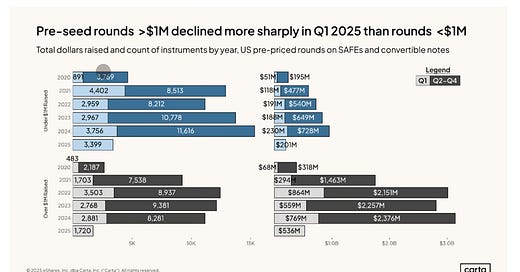

Carta released their latest report on Pre-seed funding rounds. Unfortunately, no matter how you slice it — either by total cash raised or total number of rounds done—funding at this stage has declined. Perhaps unsurprisingly, the number of rounds greater than $1M declined more so than those rounds raising sub $1M.

STV Take: I’m not totally surprised that you’re seeing fewer dollars put into $1M+ Pre-seed rounds. Usually, the $1M+ rounds have some institutional investor participation. Like every stage, the metrics needed to raise have increased and Pre-seed institutional investors want to see some amount of traction before they invest. This means that founders are probably taking on a small amount of angel funding to get very early market validation before they raise a more formal Pre-seed.

While the above explains some of the shift, I think this is also a reflection of how easy AI has made generating a basic MVP or website. Sure, you’ll eventually need something more robust, but it’s quicker than ever to get something visual into the hands of potential customers to see if an idea is even worth pursuing. As more companies show up at Pre-seed with preliminary validation, this raises the bar on the level of traction investors expect to see at this stage.

🙇♂️ (More) SAFE Advice

In a Crunchbase article, Ling Kong discusses the history of SAFEs, why SAFEs can be a good tool for first funding rounds, and the potential pitfalls for both founders and investors. Similar to what we highlighted last week, Ling mentions that one of the biggest potential pitfalls for founders is underestimating the dilution they’re taking on as they raise capital.

“To complete a typical pre-seed round, founders often raise capital from five to 15 investors using multiple SAFEs, each potentially with slightly different terms. That can complicate cap table modeling and surprise founders later. Median dilution from large SAFE rounds now hovers around 20%.” — Ling Kong

STV Take: Kong cites Carta data about how uncommon it is for investors to invest on a SAFE with no valuation cap—only 9% of SAFEs include a discount with no valuation cap, while 1% have no valuation cap and no discount. It simply isn’t market to raise on a SAFE with no valuation cap. Founders trying to do so will come across as out of touch to most investors. More than that, though, with no valuation cap, there really isn’t an incentive for an investor to take an early risk. From an investor’s perspective, why not just wait until the next round?

📖 AI Trends Report

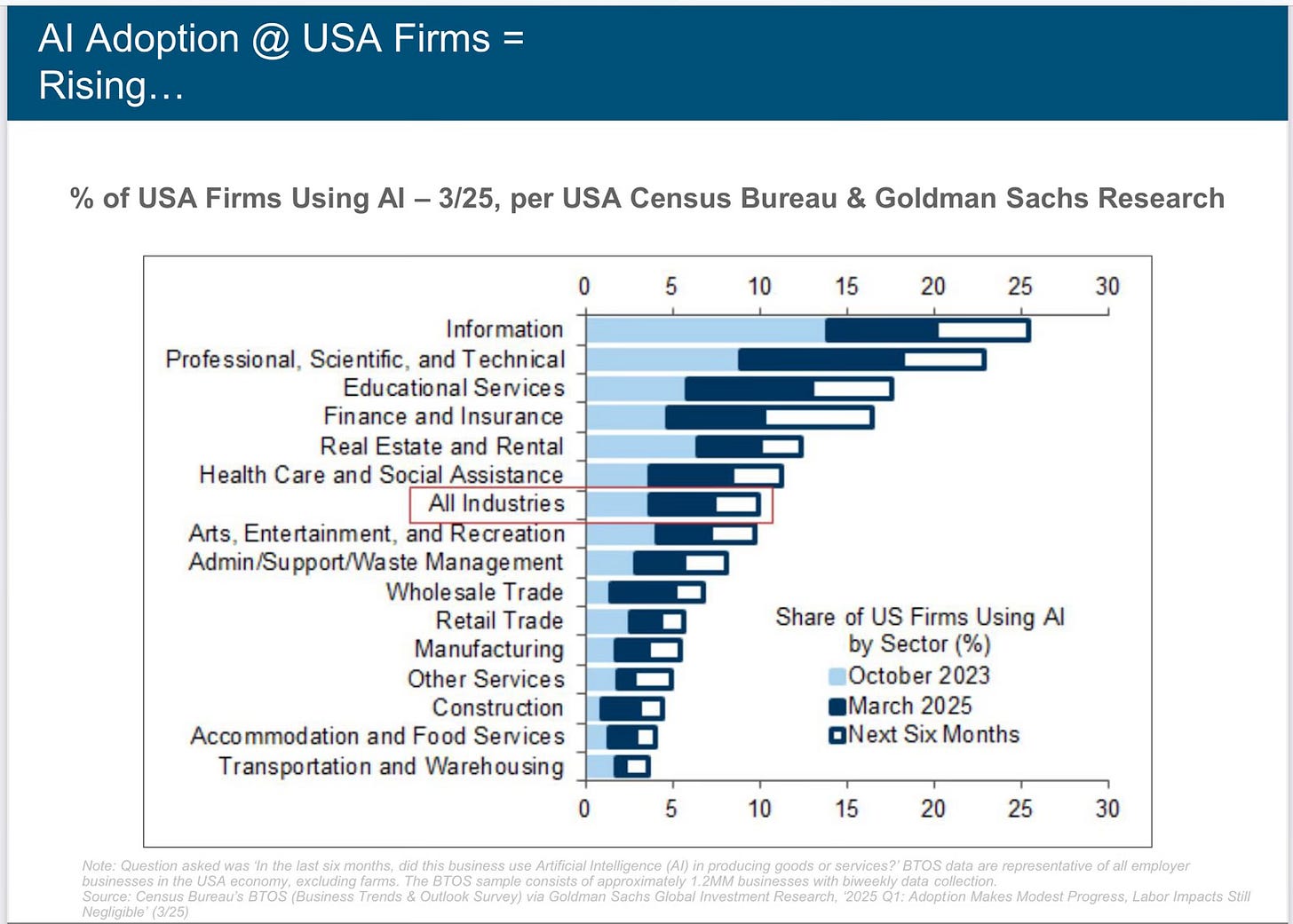

Mary Meeker and her firm, BOND, released a 340-page report on the trends in artificial intelligence. This report contains data covering a variety of AI topics, including the rapid increase of AI usage, compute costs, and the potential impact AI will have on work.

STV Take: As you can probably imagine, a report of this size is going to be dense. If you’re only going to read one section, I recommend it be the last one, which discusses AI in the workplace and the areas it’s likely going to disrupt. One point discussed in this section is how AI will erode the layers of complexity around entrepreneurship, sparking more business creation.

No matter what you believe about the hype around AI, it’s hard to read this report and not be excited about the next 5 to 10 years. It really does feel like we are in the midst of a remarkable technology shift, making it more exciting than ever to be starting a business or investing in startups.