The State of Startups + Investor Outreach Tips

We are bringing you new Carta data and advice for connecting and meeting with VCs.

Greetings! Another winter storm is upon us…❄️❄️

📑 2024 State of Startups

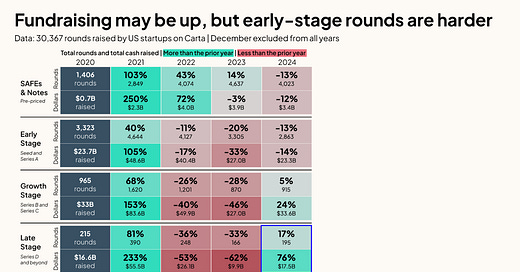

Carta released their annual State of Startups report; it’s 100 slides of data! The report starts with an overall take of how venture capital is trending relative to prior years. The authors then dive deeper into specific areas, including cofounding team dynamics, funding into AI-based companies, comparisons of funding in different metro areas, and fund performance. The key takeaways are similar to prior reports we have covered: While the total cash raised by startups in 2024 was lower than the peak of 2021 and 2022, if you take out those anomalies, 2024 is still one of the better years to be a founder fundraising. That said, meaningful liquidity remains elusive.

STV Take: I’m blown away by the top rows and the huge increase in the number of companies raising (and dollars going into) pre-priced rounds in 2024 versus in 2020! Yet, if you look at the number of rounds and dollars going into companies at the subsequent stage—the priced Seed or Series A rounds—they decreased in 2024 relative to 2020. Generally speaking, these data points help shed light on why getting past the first round of financing feels so difficult for many founders right now—there is a lot more competition now than in recent memory for capital at the Seed and Series A. Consequently, investors can be more selective and raise the bar for the types of companies they fund, which as we already know, is happening.

🗄️ Investor Startup Sorting

Haley Bryant, an investor at Hustle Fund, wrote a LinkedIn post describing her process for sorting through the cold inbound she gets from founders. In the post, she describes certain categories that are easy no’s and why, along with tips for founders when reaching out to investors. Specifically, she mentions highlighting two to three key points about the business to help stand out from the crowd.

STV Take: The aforementioned Carta report emphasizes how competitive fundraising is right now at the Seed and Series A stages. Investors are inundated with potential investment opportunities and have to quickly sort through which ones are worth their time. If anything about a company feels generic, it’s usually a quick pass.

Venture is a business of outliers, so investors are always looking for something that sets a business & its founders apart. One of the best ways to do this is to highlight traction. If traction is not clear from the beginning, investors will assume there is very little to show. Another critical piece is whether the team is the right one to build a massive business in that category. Again, don’t make investors guess. Tell them your unique insights and qualifications beyond just what’s on your LinkedIn.

📚 A Primer for Pitching to VCs

If you’re just starting to think about raising money for your startup, this GoingVC post is a good place to start. It starts by explaining the typical investor funnel and makes suggestions for how to connect with VCs. The article then concludes with the elements that make a successful pitch, including the length of the deck and what should go in it.

STV Take: Again, one of the big takeaways from this article is how critical it is for founders to stand out. Crafting a narrative that helps investors understand the potential upside is paramount.

I agree with most parts of this article, except for the section at the end that discusses who on the team should pitch. My opinion is that it should be the CEO, not whoever is “most personable and enjoys communicating the most”. That might work with angel investors, especially if the investor holds some kind of relationship with one of the founders, but if a relationship with an investor is new, the expectation is that the CEO will drive that conversation. Many early-stage investors consider fundraising to be a key part of a CEO’s role and could be put off if someone else on the team is managing the fundraising process. Most importantly, early-stage founders should not use a broker. I know this is common in other areas of finance, but it is definitely not the norm in the Seed-stage VC world.