VC Triggers

This week we cover red flags for investors, data on founder pay, and steps founders should take before fundraising.

Greetings! December is flying by. We hope you’re gearing up for a strong finish to the year!

😣 VC Triggers

Jenny Fielding, co-founder of Everywhere Ventures, started a somewhat tongue-in-cheek X thread asking if early-stage investors had strong thoughts on Pre-seed and Seed founders having executive assistants (EAs). TechCrunch ran with it and released an article that described other red flags for early-stage investors, including excessive salaries for founders and COOs and CFOs.

“While most seed investors, including Fielding, believe founders should spend their raised cash ‘how they want to,’ early-stage VCs will still be judging founders’ cash management, even if the VC is basically a silent partner.”

— Julie Bort

STV Take: I’ll start by saying that I have heard the argument that an EA can free up the CEO for higher-level tasks. I sort of get that but think that statement is less true now that there are so many AI (and non-AI, if you’d prefer) scheduling tools out there.

However, high salaries for founders is one I see more frequently, especially from folks coming from the corporate ranks. Most investors don’t want founders taking a pittance; if a founder can't pay their rent, it’s highly unlikely they will be able to focus on the business, but there is a middle ground. As Jenny mentions in the article, a reasonable salary for Pre-seed founders is somewhere between $85K to $125K. Going significantly higher than this is problematic because runway is usually so limited in the early days and capital efficiency is paramount.

💸 How Should Founders Pay Themselves?

This Carta podcast featuring Waseem Daher, Founder and CEO of Pilot, is a good follow-up to the above point about founder salaries. As a tech-enabled accounting firm, Pilot has access to data from over 2,000 companies across various geographies and stages, allowing them to extract valuable insights—especially around topics like founder salaries, which are explored in detail during the first part of the podcast. In the second half, the conversation shifts to key topics such as KPIs, managing burn, and strategies for approaching layoffs.

“In a way that is well intentioned, they’re [founders are], like, I need to sacrifice everything to make it possible for my startup to succeed, and that instinct isn’t wrong per se. But, I think the thing it overlooks, or I think the mistake many founders make is, if you don’t pay yourself enough, what ends up happening is you start worrying about your personal expenses as opposed to worrying about the success of the business.”

— Waseem Daher

STV Take: Aside from the salary discussion, one segment that is short but very informative for founders is around the 12-min mark. The discussion starts with Peter’s question around what is a good burn rate. Waseem explains that, of course, it depends on the business, but that a good rule of thumb is to look at the burn multiple; i.e., how much ARR is added relative to how much is spent. In a market where capital efficiency is more prized than ever, that ratio should be about one to really stand out.

🧭 A Guide to Optimizing Financial Performance

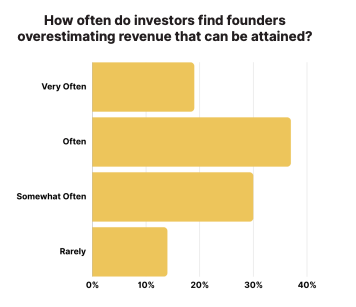

AVL Growth Partners released a new guide that highlights the key three financial drivers of a startup, along with recommendations to help founders avoid common financial modeling pitfalls and the best way to project business growth. A few of the common mistakes AVL Growth discusses in this guide include:

Overestimating attainable revenue

Misunderstanding how quickly revenue can grow related to COGs

Underestimating customer acquisition cost

STV Take: Investors understand that a company’s revenue expectations and growth projections presented in a pro forma are educated guesses at best and shots in the dark at worst. Investors can sniff out the latter. While uncertainty is inevitable regarding early revenue growth, there are techniques and best practices founders can use to generate a solid understanding of their cost drivers and present realistic expectations for potential revenue growth. AVL Growth’s latest guide offers valuable tips to help founders craft the best version of their pro forma. (Sponsored)

✏️ Steps to Prepare for Fundraising

In a recent Crunchbase article, guest author Murad Salikov, Co-founder of Schwarzwalk Capital, discusses the steps founders just starting out should take to help them run a competitive fundraising process. Some of the steps he recommends are the following:

Define your funding needs and timeline;

Ensure your company has a proper legal structure and records are up to date; and

Create a detailed financial forecast.

“Before seeking funding, ask yourself if your startup truly needs investment right now.”

— Murad Salikov

STV Take: As Abby Mercado discusses in episode 150 of the VC Minute, there are multiple ways to fund a business and not every founder wants or should take venture capital in the early days. Assuming you’ve done the work to validate that VC is the right path, the next step is figuring out what exactly you need funding for and how that gets you to a set of business goals that unlocks the next round of funding (remember, VC is a treadmill).

In my experience, most founders have a good handle on what they will spend investment capital on but occasionally struggle with how much they’re raising. When asked how much they’re targeting for the round, the answer is a range, not a specific amount. I’m guessing (but you tell me!) that this stems from wanting to appeal to a broader investor base and/or trying to position things in case only a small amount can be raised, but this can work against founders. If the range of a round size is too broad, investors will be skeptical that founders truly know how much money it will take to get to the next round.