What does it take to raise a Series A?

This week we are highlighting the critical benchmarks needed to successfully raise a Series A, new B2B SaaS growth metrics, and insights into an investment process.

Greetings! We are excited for October and all of the in-person events on the schedule!

📊 Critical Metrics for Raising a Series A

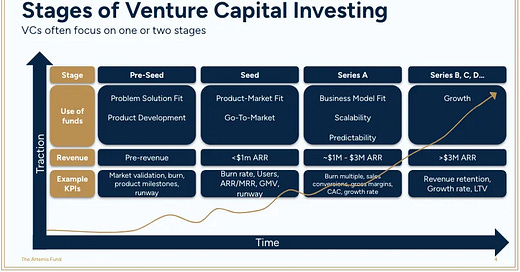

The Artemis Fund released an article discussing the critical metrics and qualitative attributes of companies that successfully raise a Series A or B. The article starts with the chart below, which is a nice summary of what investors look for at different stages:

STV Take: Even I was a little shocked to see the stats in this article comparing the number of startups that raised a Series A within two years in Q1 2018 versus Q1 2022 (27.4% and 12.1%, respectively). As the data show, it’s harder than ever to stand out in the sea of Seed companies trying to progress to a Series A, but it is sometimes difficult for founders to know how they stack up. This is why I thought the inclusion of metrics around what constitutes ok, good, and great was an especially noteworthy part of the article. SpringTime’s experience is consistent with the data in this article: A company with a good chance of raising an A round has a run rate of $2-3M and is growing 2-3x year-over-year. Thinking about these milestones is important as founders work backwards to identify how much they potentially need to raise at the Seed round.

🚀 New B2B SaaS Metrics

SaaS Capital released their latest B2B revenue growth benchmarks. In it, they compare growth rates of companies by age of the business, amount of revenue, and bootstrapped vs. equity backed. Notable data points include:

The average annual growth rate for an equity-backed B2B SaaS company doing <$1M in revenue in 2023 was 100%, up from 50% in 2022.

Companies (both bootstrapped and equity-backed) doing <$1M had a median growth rate of 59%. Those in the top quartile grew ARR by 106%.

Companies with net revenue retention >130% had a median growth rate of 70% compared to a median growth rate of 17% for those with net revenue retention <90%.

STV Take: A key point made in this article is how critical growth rates are to raising venture capital. If a company is doing <$1M in ARR and has a below median growth rate, it is going to be incredibly tough to raise venture capital. While The Artemis Fund article referenced above includes growth rates as one of their core metrics, how these factor into being able to raise a Series A isn’t something I have seen founders question until recently. Instead, most of the time, the focus centers around a revenue benchmark, but revenue in a vacuum is meaningless. Investors will value a company doing a $1M in revenue with a slow growth rate very differently than a company doing half the revenue but growing rapidly.

🧭 A Guide to Optimizing Financial Performance

AVL Growth Partners released a new guide that highlights the key three financial drivers of a startup, along with recommendations to help founders avoid common financial modeling pitfalls and the best way to project business growth. A few of the common mistakes AVL Growth discusses in this guide include:

Overestimating attainable revenue

Misunderstanding how quickly revenue can grow related to COGs

Underestimating customer acquisition cost

STV Take: Investors understand that a company’s revenue expectations and growth projections presented in a pro forma are educated guesses at best and shots in the dark at worst. Investors can sniff out the latter. While uncertainty is inevitable regarding early revenue growth, there are techniques and best practices founders can use to generate a solid understanding of their cost drivers and present realistic expectations for potential revenue growth. AVL Growth’s latest guide offers valuable tips to help founders craft the best version of their pro forma. (Sponsored)

📅 What to Expect After the First Meeting

NextView discusses their investment process beginning with the screening call and ending with the investment offer. The high-level process is fairly straightforward and consists of the following main steps:

Pre-screening meeting

First partner meeting

Second partner meeting

Diligence

Broader team meeting

Partner meeting

In addition to providing an overview of the process, the NextView team also explains how founders should think about structuring the meetings and the types of questions an investor is trying to answer at each step.

“The first rule of venture fundraising is that the purpose of all VC meetings is to get another meeting. It’s not to immediately push a decision.“

STV Take: This process is actually quite similar to how SpringTime runs our decision making process. The one exception is that our first call is always done with a partner but the goal of the call is consistent with NextView’s pre-screen and first partner calls, which is to suss out whether this opportunity is worth an hour (the length of our second meeting) of our partners’ (and the founder’s) time.

I’d reiterate that the diligence period can feel ambiguous because, well, it is, but founders can gauge a likely outcome by how much an investor is engaging. In other words, more communication from an investor is better. If communication has been slow, the interest level is likely lower. The other thing I’ll add is that some of the diligence work can happen between the first and second call, which might lengthen the time between these two calls. Because we value founders’ and our partners’ time, we want to make sure the investment is high potential before we schedule a second call. If we are intrigued but have big questions around the market or team, we try to suss this out before scheduling a follow-up call.