What to Include in a Pre-seed Pitch

This week we cover the state of HealthTech, the critical elements of a Pre-seed pitch, and a behind-the-scenes look at what happens after a pitch.

Greetings! It’s Halloween week and we hope you have an awesome costume or scary movie teed up for tomorrow! 🎃

🩺 State of HealthTech

Bessemer Venture Partners released their annual report on HealthTech. The report starts with a discussion of the sector’s public market performance before delving into investment trends in the private markets. The authors also include various business metrics for their three most observed HealthTech business models—healthcare SaaS, tech-enabled clinical services, and AI Services-as-a-Software. As you can probably guess, that last category is experiencing unprecedented revenue and investment growth.

STV Take: I am convinced healthcare is the only reason so many fax-from-photo apps on smartphones exist—the industry is not known for being an early adopter of risky, early-stage technology. With that in mind, it’s remarkable to see how quickly these early healthcare AI companies are growing revenue. One partial explanation for this that the authors point out is that early revenue for healthcare companies tends to be what they call “experimental”, meaning it’s money for a pilot-like engagement to see if the company can deliver on its ROI promises. Based on what I’ve read and heard, this is happening in most sectors, not just healthcare. Large companies are testing startups’ technologies to see what best fulfills their needs. Because of how sticky some of these solutions can be, AI companies are in a perceived land grab to demonstrate value and lock in customers, which I can see tenuously justifying the need for larger rounds; however, it’s clear that if founders want to raise these larger rounds, the bar for revenue growth for early-stage AI businesses, at least in healthcare, is high.

🧭 A Guide to Optimizing Financial Performance

AVL Growth Partners released a new guide that highlights the key three financial drivers of a startup, along with recommendations to help founders avoid common financial modeling pitfalls and the best way to project business growth. A few of the common mistakes AVL Growth discusses in this guide include:

Overestimating attainable revenue

Misunderstanding how quickly revenue can grow related to COGs

Underestimating customer acquisition cost

STV Take: Investors understand that a company’s revenue expectations and growth projections presented in a pro forma are educated guesses at best and shots in the dark at worst. Investors can sniff out the latter. While uncertainty is inevitable regarding early revenue growth, there are techniques and best practices founders can use to generate a solid understanding of their cost drivers and present realistic expectations for potential revenue growth. AVL Growth’s latest guide offers valuable tips to help founders craft the best version of their pro forma. (Sponsored)

💡Pre-seed Pitch Feedback

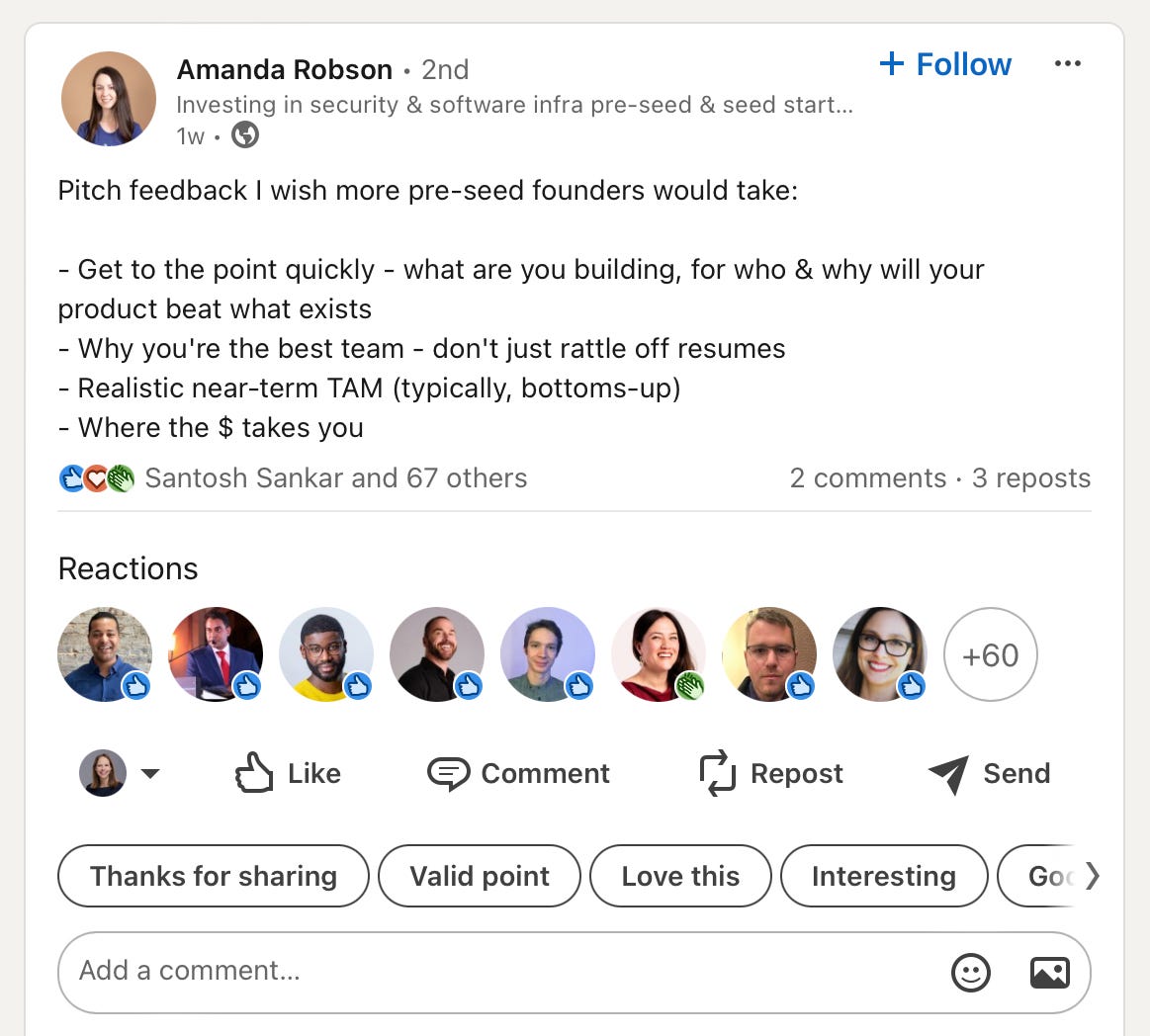

Amanda Robson, Founder at Modern Angels, provided succinct pitch advice for Pre-seed founders on LinkedIn. Below is a screenshot of the post and the four key points she thinks founders should make during a pitch:

STV Take: The Pre-seed pitch is exceptionally hard because it’s usually the first time the business narrative is being told externally and there are still so many unknowns of the business. Additionally, for many founders, it’s the first time they’ve attempted to raise outside capital, and they lack the confidence (usually because they don’t know what to expect) to excel at pitching. Because of that, I see founders over-index on areas where it at least feels like there is more certainty, such as potential product features, and neglect other meaningful areas, such as the team.

We have said this so many times before that I’ve lost count, but at the Pre-seed, team is make or break for an investment decision. As Justin Izzo from Docsend covers last week on episode 267 of VC Minute, founders either put too little or too much information on their team slide for it to be useful. Too often, this slide consists of a bunch of logos of big companies where founders have worked, but there are lots of people that have worked at these companies; that, in and of itself, isn’t unique. Investors need founders to connect the dots on how a founder’s unique blend of experiences gives them a competitive advantage. It’s easy to deprioritize the storytelling around the team, because it seems so obvious—how would you not know your background?—but taking the time to craft a great narrative that explains why this is the team to win is is critical for securing early-stage investment.

🎙️ The Pitch: ESAI

The Pitch is a podcast that invites tech startup founders to pitch a group of real venture capitalists. On this episode, founder Julia Dixon pitches five Pre-seed and Seed investors on her business, ESAI, which leverages AI to help students identify, apply, and select colleges and scholarships. Over the course of the 20-minute pitch, Julia is quizzed by the investors on areas such as customer acquisition, revenue model, and whether the potential size of the business is big enough. Ultimately, two investors committed a total of $75,000 to ESAI’s $1M Pre-seed round.

“We’re coming at it from our own world view of education, which just shows that investors are going to pick what they’re attracted to and what they want to actually spend their intellectual time on. That’s the type of investor you want.”

- Cyan Banister

STV Take: Overall, I really enjoy this podcast because it provides a front row seat into how investors think and respond to pitches in a way that feels so much more real than any Shark Tank episode I have ever seen. While the episodes usually include a founder pitch and Q&A with the founder, there is some element of the investors discussing the business amongst themselves and outlining their concerns. In one of those behind-the-scenes moments, the host asks the two investors who committed to ESAI’s round if they would have made the investment if they didn’t have prior experience working with companies in higher ed. Their response? One said, “No”, and the other said, “Maybe”. The responses to that question drives home how important it is for founders to target the right investors. It’s not enough to just filter by stage. Investors with deep experience in a company’s vertical are more likely to “get it” quicker, say “yes” to an investment, and be better partners along the journey.